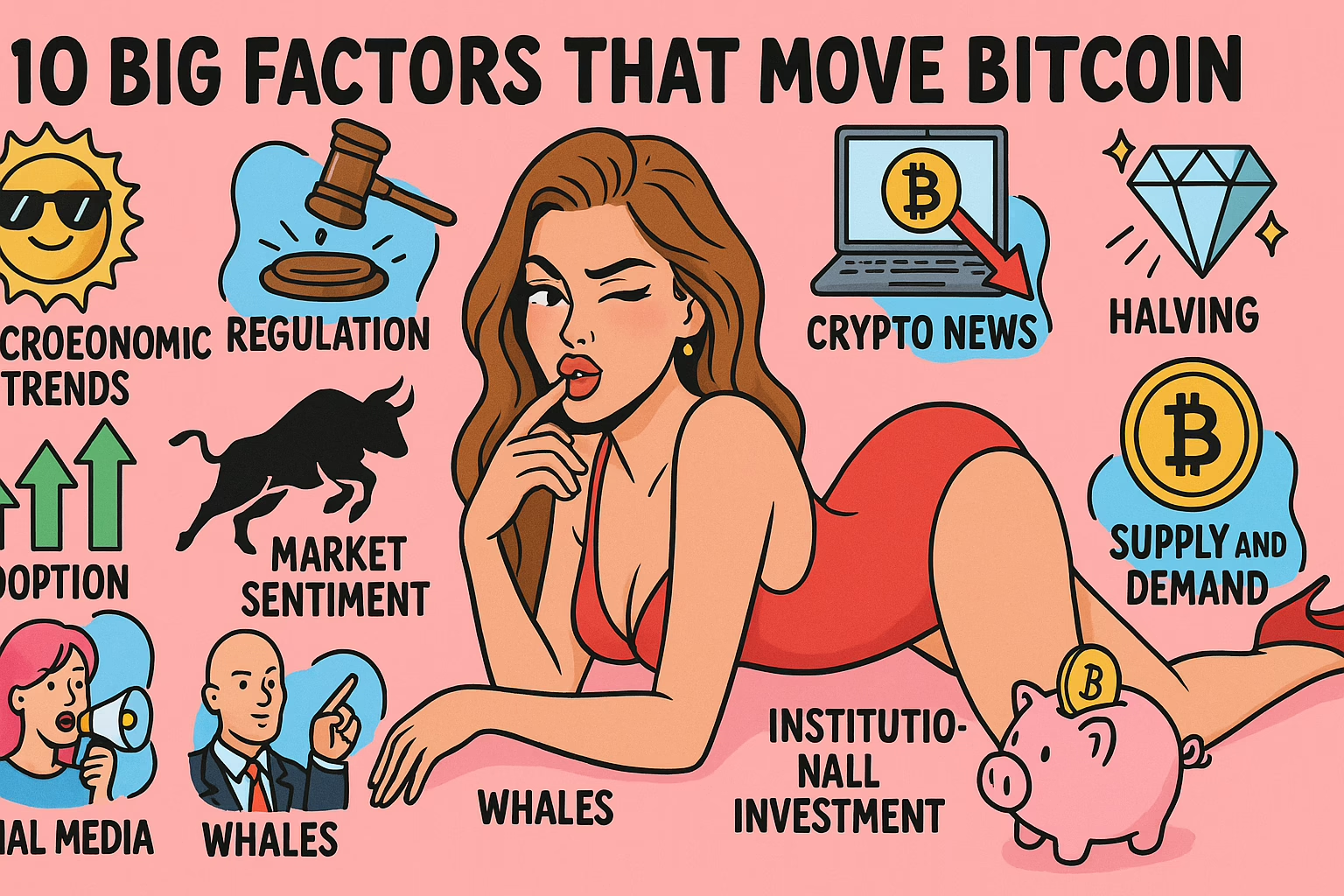

10 Big Factors That Move Bitcoin Prices

Let’s be real — Bitcoin is basically the ultimate roller coaster in the digital finance world. One day it’s skyrocketing like a rocket ship, the next it’s crashing harder than your phone screen at 3AM.

But here’s the thing — it’s not random chaos. Behind all that price drama, there’s a whole mix of forces pulling the strings.

From hardcore mining tech to global political shakeups, every single piece plays a part in shaping Bitcoin’s price.

Principal Conclusions

Hide-

Supply & Demand: Price moves with investor appetite and coin availability.

-

Mining Costs & Hash Rate: Energy + tech = security + trust.

-

Regulation: One law can shake or boost the market.

-

Sentiment & Media: Hype drives spikes, fear fuels dips.

-

Macroeconomics: BTC reacts to inflation and fiat drama.

-

Tech Upgrades: Innovation builds long-term value.

-

Institutional Adoption: Big names = big trust.

-

Network Utility: Real usage = real value.

-

Geopolitics: Crisis can push BTC as a digital safe haven.

-

Halving: Scheduled scarcity = future fuel for bull runs.

If you’re curious about why BTC’s value can go so wild, this guide will help you break it all down — in a chill, digestible way.

Summary Table: What Moves Bitcoin’s Price?

| Factor | Quick Description |

|---|---|

| Supply-Demand | Circulating supply vs investor demand |

| Mining Costs & Hash Rate | Energy expenses, hardware, and network difficulty |

| Government Regulation | Bans, approvals, or government support |

| Market Sentiment & Media | Headlines, influencer buzz, and speculation |

| Macroeconomics | Inflation, interest rates, and fiat currency value |

| Tech Developments | Protocol upgrades and innovation |

| Institutional Adoption | ETFs, derivatives, and big companies getting involved |

| Network Activity & Utility | Daily transactions and DeFi ecosystem on the network |

| Geopolitical Events | Conflicts, wars, and global recessions |

| Halving Events | Block reward reductions every ~4 years |

1. Supply vs Demand: The Classic Tug of War

Bitcoin has a hard cap of 21 million coins. That’s it. So if you thought BTC can just be printed like fiat money — think again. With a fixed supply and growing demand, it’s basically a textbook setup for price volatility.

Whenever people rush to buy (because of hype, inflation fears, or financial uncertainty), but supply doesn’t increase, prices soar.

On the flip side, if demand tanks and everyone starts selling? Prices can dip hard. It’s classic economic pressure — just cranked up to crypto speed.

2. Mining Costs & Hash Rate: The Technical Battleground

Mining Bitcoin isn’t some “press a button, get rich” fantasy. It’s expensive. Think high electricity bills, pricey GPUs, and monster cooling systems to prevent rigs from catching fire.

If operational costs get too high and BTC’s price doesn’t keep up, miners might dip out — and that weakens the network.

The hash rate — aka how much computing power is securing the network — shows how healthy things are.

If it’s high, more miners are in the game, meaning stronger security. If it drops, trust in the system can fade, and the market can react fast. So yeah, it’s not just about cost, it’s about confidence.

3. Government Regulation: Green Lights or Red Flags?

One government announcement can flip the entire market. When China banned crypto mining and trading? Prices crashed. But when the US approved its first spot Bitcoin ETF? The market lit up like Times Square.

Regulation is basically the traffic light for crypto: green for go (adoption!), yellow for caution, red for panic mode.

Since there’s no global playbook for how to regulate Bitcoin, every country doing its own thing makes the market super sensitive.

4. Market Sentiment & Media: The Tweet That Shook the Market

Ever seen Elon Musk tweet something and suddenly Bitcoin either flies or crashes? That’s sentiment at work. In crypto, perception often hits harder than logic.

One rumor can fuel a buying frenzy, while one piece of fake news can trigger panic selling.

Platforms like Twitter, Reddit, and even YouTube have the power to sway millions of investors in minutes.

FOMO (fear of missing out) and FUD (fear, uncertainty, doubt) drive huge market moves. Even small headlines can cause big tremors.

5. Macroeconomics: The Global Winds That Shift Prices

Bitcoin doesn’t float in a bubble. It’s tied to the broader economic ecosystem. When inflation is high, interest rates are low, or the US dollar weakens, investors start eyeing “hard” assets like gold — or Bitcoin, the so-called digital gold.

For example, when the US Federal Reserve slashes rates, people worry about holding cash that’s losing value. BTC becomes a hedge — a protection.

But when interest rates rise? Investors often pull out of risky assets like crypto and head for safer ground.

6. Tech Developments: Upgrades That Power the Engine

Bitcoin isn’t just about price charts — it’s powered by tech that evolves. When the Bitcoin network upgrades (like the Taproot upgrade), it gets faster, more private, and more useful — which gets developers and users excited.

There’s also the Lightning Network, which speeds up transactions and cuts costs — making BTC actually usable for everyday payments. As tech evolves, it boosts Bitcoin’s real-world utility — and that adds serious value.

7. Institutional Adoption: When the Big Dogs Join In

When heavy hitters like Tesla, MicroStrategy, or BlackRock step into the Bitcoin game, it’s like a loudspeaker announcing: “Hey, this isn’t just a nerd experiment anymore.”

Especially after the approval of spot ETFs in 2024 — Bitcoin hit $73K and the market went wild.

Institutions bring in massive liquidity and help ease the fears of retail investors. These players don’t just YOLO in — they do deep research before making a move. Their presence = trust + momentum.

8. Network Activity & Utility: Bitcoin is Alive, Not Just a Price Tag

Behind every candlestick chart are real people making real transactions. Metrics like daily transaction count, active wallet addresses, and decentralized apps built on the Bitcoin network (think DeFi, NFTs, etc.) show how alive the system really is.

If these numbers are climbing, it’s a good sign — people are actually using the network. If they’re stagnant or dropping, it could mean the market’s cooling off.

Smart investors always peek at on-chain data to read the vibes before making a move.

9. Geopolitical Events: Bitcoin as the Borderless Backup Plan

Whenever the world’s in chaos — war, pandemics, or political tensions — Bitcoin often steps up as a “safe haven.”

When stock markets shake and banks wobble, Bitcoin becomes the digital escape route. Why? Because it’s borderless, decentralized, and doesn’t follow any one government’s rules.

For example, during Middle East conflict scares, Bitcoin nudged up by 0.7% while global stocks sank. It’s not immune to fear, but people see it as a plan B when the usual systems feel shaky.

10. Halving Events: Every Four Years, Things Get Real

One of Bitcoin’s most unique traits? The halving. Roughly every four years, the amount of BTC that miners earn per block gets cut in half. This reduces the pace of new supply — meaning the digital gold gets even scarcer.

Historically, halving events have been followed by strong price rallies — usually within 12 to 18 months.

Because of that, many investors start stacking sats (satoshi = smallest BTC unit) ahead of time. It’s like a countdown to a new wave of scarcity-driven demand.

Final Thoughts: It’s Never Just One Thing

Bitcoin’s price doesn’t move because of one magical tweet or just because a new upgrade drops. It’s the result of a complex, ever-changing mix of forces — economics, tech, regulation, market moods, and global events.

If you want to thrive in crypto, you need a 360° perspective. Reading charts isn’t enough. You’ve got to combine technical analysis, fundamentals, and sentiment. Understand the full context, not just the moment.

So don’t get tunnel vision on today’s price. Zoom out. Think big picture. Crypto is fast, wild, and unpredictable — but with a solid grip on the key drivers, the upside is huge.

Frequently Asked Questions (FAQs)

How can I track Bitcoin market sentiment?

Use tools like Google Trends, Twitter sentiment trackers, and the Crypto Fear & Greed Index to get a feel for the emotional pulse of the market.

How often does Bitcoin halving happen and how should I prepare?

Every 210,000 blocks — around every 4 years. Smart investors usually start accumulating before the halving, knowing that scarcity tends to drive prices up after.

Do tax laws affect Bitcoin’s price?

Absolutely. When governments impose capital gains taxes or stricter tax rules, it can discourage both retail and institutional investors — leading to reduced demand and lower prices.

What’s the most powerful factor?

There isn’t one single kingmaker — it depends on the cycle. During halving seasons, supply dynamics take the lead. During economic crises, macro factors dominate. It’s all about timing.

How do I measure Bitcoin’s network security?

Check the hash rate and mining difficulty. The higher they are, the more secure the network is, and the harder it is for bad actors to pull off attacks.