Top 10 Crypto Investment Calculator

Crypto investment calculators offer a convenient way to estimate profits, losses, and overall portfolio performance by allowing users to input basic trading data or sync accounts for automated insights.

As cryptocurrency investing becomes more mainstream, having the right tools to manage and evaluate your returns is essential. These calculators can streamline decision-making and improve financial planning.

In this article, we explore the best crypto investment calculators available today to help you choose the one that fits your needs.

Key Takeaways:

ShowThe Best Crypto Investment Calculators

Crypto investment calculators are specialized tools designed to help investors and traders evaluate the profitability of their cryptocurrency holdings.

These calculators allow users to input details such as purchase price, selling price, trading fees, and investment duration to estimate their returns or losses.

Many of these tools go beyond basic calculations, offering features like tax calculating, real-time portfolio and profit syncing, DeFi yield tracking, and integration with hundreds of exchanges and wallets. Crypto calculators come in various formats to suit different user preferences.

Most are web-based, requiring no installation and accessible from any browser, while others are available as mobile apps for iOS and Android, software applications, or browser extensions.

Some offer manual input options for quick estimates, while more advanced versions connect directly to wallets and exchanges via API for automatic data tracking and real-time analytics.

To help you find the most suitable tool for your investment strategy, we’ve compiled a comprehensive review of the best crypto investment calculators:

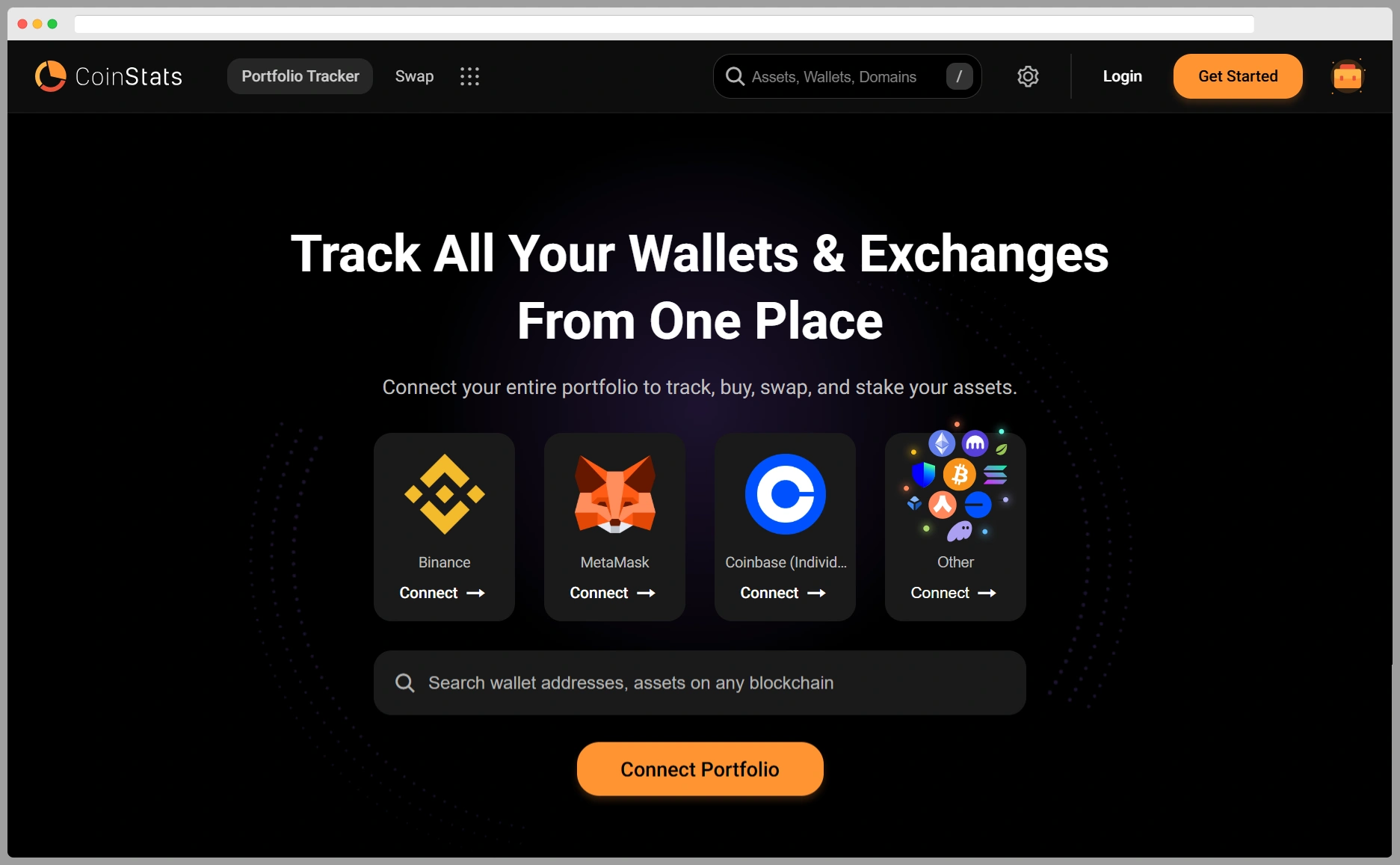

1. CoinStats – Top Real-Time Portfolio and Crypto Calculator

- Features: Connects wallets/exchanges for real-time profit/loss tracking; advanced analytics; supports many coins; military-grade encryption

- Pros: Automatic portfolio sync; real-time updates; user-friendly; mobile access; secure

- Cons: Some advanced features require paid plans; API integration setup may be complex for beginners

- Best for: Investors managing multiple wallets/exchanges

- Pricing: Free basic plan; paid plans for advanced features

2. CoinLedger – The Best Crypto ‘What If’ Calculator

- Features: Imports transaction data from wallets/exchanges; calculates profits, losses, tax reports; “What If” scenario tool

- Pros: Simplifies tax compliance; handles large volumes of transactions; user-friendly

- Cons: Focused on tax reporting, may be complex for casual users

- Best for: Traders needing tax compliance and portfolio tracking

- Pricing: Free basic plan; paid plans for tax filing features

3. CoinCodex

- Features: Simple profit/loss calculator; includes future profit projection with additional contributions and growth rates

- Pros: User-friendly; good for long-term investment planning

- Cons: Limited wallet integration; basic compared to portfolio trackers

- Best for: Long-term investors planning future growth

- Pricing: Free

4. De.Fi – The Best Decentralized Crypto Calculator

- Features: Tailored for DeFi investments; calculates yield farming and liquidity pool returns; scam checks

- Pros: Specialized for DeFi users; security features; covers both traditional and DeFi investments

- Cons: Less suitable for general crypto portfolio tracking

- Best for: DeFi investors and yield farmers

- Pricing: Free

5. TokenTax – Tax Combined Crypto Investment Calculator

- Features: Calculates profits and tax compliance; integrates with many exchanges/wallets; generates tax reports

- Pros: Excellent for tax filing; detailed gain/loss and income tracking

- Cons: Paid service primarily; tax focus may be unnecessary for casual investors

- Best for: Serious traders and tax-focused users

- Pricing: Paid

6. Good Calculators – The Best Free Crypto Invest Calculator

- Features: Supports multiple cryptocurrencies; requires manual input of investment, prices, fees; detailed profit/loss output

- Pros: Simple and comprehensive; wide crypto support

- Cons: No wallet/exchange integration; manual data entry required

- Best for: Beginners and casual investors

- Pricing: Free

7. Coincalc – The Best Large Porto Crypto Calculator

- Features: Detailed input interface; supports many cryptocurrencies; calculates profit/loss with fees

- Pros: Versatile for diverse portfolios; user-friendly

- Cons: Manual input only; no automatic syncing

- Best for: Diverse crypto portfolios

- Pricing: Free

8. Koinly – The Most Diverse Crypto Investment Calculator

- Features: Portfolio tracking and tax reporting; integrates 800+ exchanges and wallets; tracks staking, mining, DeFi

- Pros: Extensive integrations; detailed tracking; tax compliance

- Cons: Paid plans required for full features; complex interface for beginners

- Best for: Tax-conscious investors and active traders

- Pricing: Free basic tier; paid plans available

9. Botsfolio – Top Personalized Crypto Calculator

- Features: Calculates potential returns on premade/custom portfolios; factors investment period and contributions

- Pros: Portfolio management and simulation; AI-based portfolio options

- Cons: Limited to portfolio presets; less manual control

- Best for: Investors seeking portfolio automation

- Pricing: Free

10. Binance Calculator – Beginner Friendly Calculator

- Features: Quick conversion and profit/loss calculator based on current market prices; supports futures trading

- Pros: Fast and easy; supports futures with leverage; good for active traders

- Cons: Limited to Binance ecosystem; basic compared to portfolio trackers

- Best for: Active traders on Binance

- Pricing: Free

How to Use Crypto Investment Calculator

Crypto investment calculators are valuable tools for estimating your potential profits or losses based on your trading activities.

Whether you’re a casual investor or an active trader, understanding how to properly use these calculators can help you make informed decisions and optimize your portfolio performance.

These tools typically require inputs such as the amount invested, buy and sell prices, and any associated fees, and many offer advanced options like real-time syncing with wallets and exchanges.

To make the process clear and actionable, we’ll walk show how to use one of the most popular and user-friendly tools on the market, with CoinStats Crypto Profit Calculator as the example.

While the exact interface and features may vary across platforms, the steps outlined below will give you a solid understanding of how to operate most crypto investment calculators effectively.

CoinStats stands out for its ease of use, security, and integration capabilities. Here’s how to use it:

Steps 1: Access the Calculator

Go to the CoinStats website or open the CoinStats mobile app on iOS or Android.

Steps 2: Choose Your Cryptocurrency

In the calculator interface, select the cryptocurrency you want to calculate profits for (e.g., Bitcoin, Ethereum).

Steps 3: Enter Investment Details

Input the amount of your investment in the “Investment” field (e.g., $1,000). Enter the buy price (the price at which you purchased the crypto). Enter the sell price (the price at which you sold or plan to sell the crypto).

Steps 4: Add Fees (Optional)

Enter any investment fees (transaction fees when buying). Enter any exit fees (fees when selling).

Steps 5: Calculate Profit or Loss

The calculator will automatically display your total profit or loss based on the inputs.

Steps 6: Connect Wallets/Exchanges (Optional)

For real-time tracking, connect your wallets or exchange accounts via API with read-only access. CoinStats will automatically sync your portfolio and calculate profits/losses across all holdings.

Steps 7: Analyze and Plan

Use the advanced analytics to track performance over time. Plan future investments by simulating different buy/sell prices or additional contributions.

Steps 8: Security Assurance

CoinStats uses military-grade encryption and only requires read-only access, ensuring your assets cannot be moved or traded by the platform.

Security Considerations When Using a Crypto Investment Calculator

When using crypto investment calculators, it’s important to evaluate the platform’s security practices to protect your financial data. Below are key security points to consider:

- Read-Only API Access: Choose tools that only request read-only API access to your wallets or exchanges. This ensures they can view data without executing transactions.

- Data Encryption: Opt for platforms that use encryption (e.g., AES-256) to secure data in transit and at rest, minimizing the risk of breaches.

- Secure Data Storage: Verify whether the platform stores your data securely on protected servers or gives you control over local data storage.

- Multi-Factor Authentication (MFA): Look for platforms that offer MFA for added login protection, reducing the risk of unauthorized account access.

- Privacy Policy Transparency: Review the platform’s privacy policy to confirm they don’t sell or share your data with third parties.

- Reputation & Community Feedback: Check user reviews and online forums for reports of past security issues and how they were handled.

- Regular Updates and Maintenance: Prefer platforms that actively maintain their software and publish updates or security patches as needed.

Final Words

With options ranging from simple manual input interfaces to advanced platforms with wallet integration and tax reporting, there’s a solution for every type of investor.

The right crypto calculator not only helps you make smarter investment decisions but also brings peace of mind as you navigate the evolving crypto landscape.

Crypto investment calculators are practical, easy-to-use tools that can significantly enhance how you track and manage your digital assets.