Will Dogecoin Reach $5?

Dogecoin (DOGE) reaching $5 represents a transformative leap from meme novelty to mainstream medium of exchange.

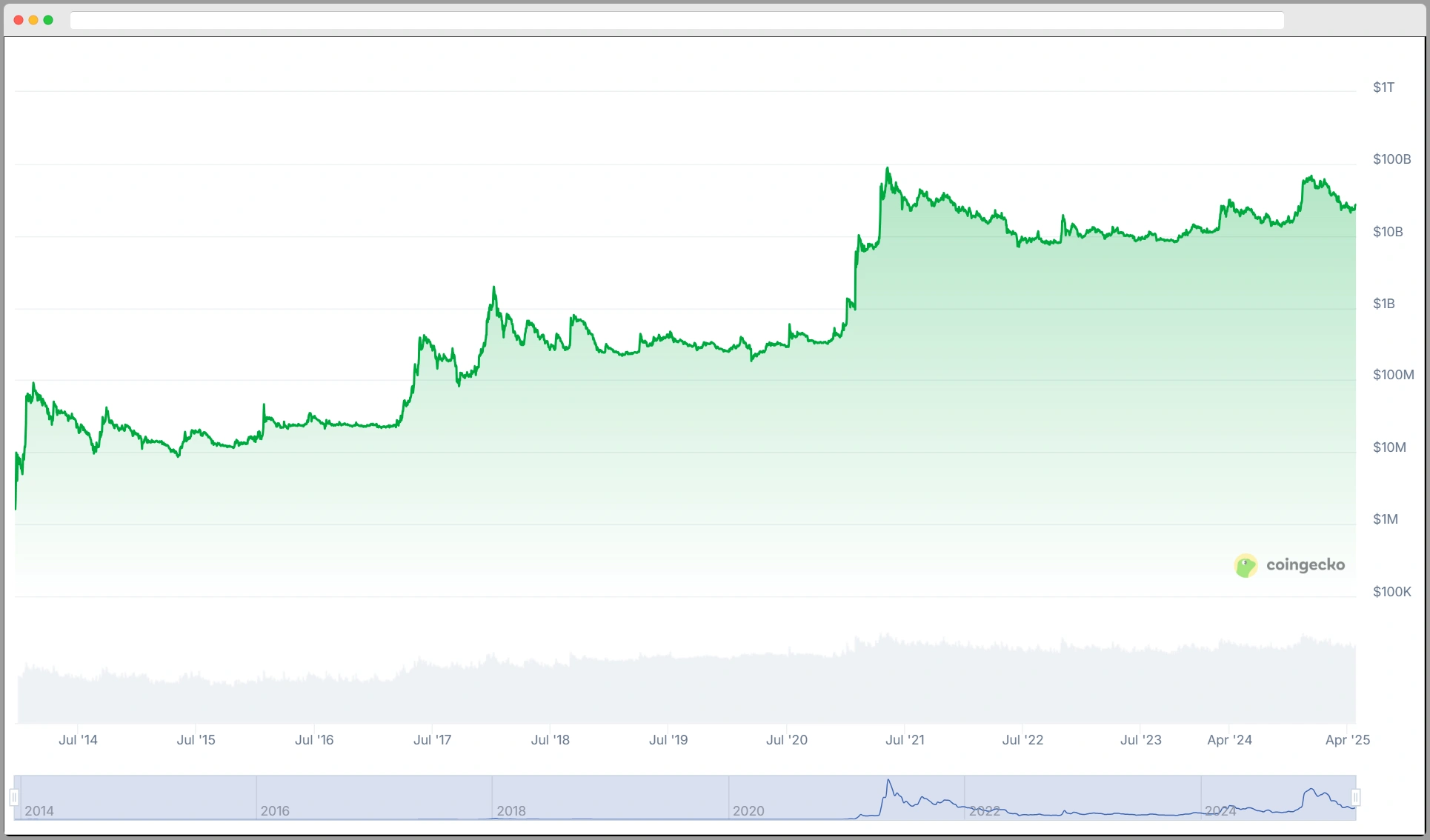

Analysts’ models vary, conservative forecasts see $1 by 2030 and $5 by 2034, while bullish cycles could accelerate a $1–$5 range between 2028 and 2030.

Such a milestone requires unprecedented synergy: mass adoption in commerce, sustained bullish crypto cycles, major technical upgrades, and relentless community advocacy.

Without all these elements aligning, DOGE’s path to $5 remains steep and uncertain.

This analysis examines the realistic catalysts, technical signposts, competitive landscape, and timing scenarios that could propel, or derail, Dogecoin’s quest for five dollars.

Key Takeaways:

Hide- Bitget Wiki: DOGE needs mainstream payment integration and 100 million daily users to approach multi-dollar value. (Source: Will Dogecoin Reach $5: An In-Depth Analysis)

- Tribune PK: Changelly sees $1 by April 2030 and $5 by June 2034 absent major catalysts. (Source: Bullish signals indicate Dogecoin could hit $5)

- TheCryptoBasic: Cup-and-handle and Gaussian channel patterns offer initial targets up to $1 before higher breakout. (Source: Analyst Predicts This Pattern)

- TronWeekly: Historical four-year cycles hint at parabolic surges; cycle alignment may precede major rallies. (Source: Dogecoin Eyes $11.71)

- Bitget Wiki: Spot DOGE ETF approval (>60% odds) could unlock institutional capital needed for sustained run. (Source: Will Dogecoin Reach $5: An In-Depth Analysis)

Price Prediction: Can DOGE Hit $5?

Forecasting DOGE at $5 demands a multi-dimensional view, market sentiment, utility expansion, technical patterns, and regulatory clarity.

Each factor alone cannot carry Dogecoin (DOGE) to five; only their confluence can overcome the immense resistance between current levels and that ambitious target.

Utility and Real-World Integration

DOGE must evolve from tipping token to transactional currency. Achieving integration with major payment processors, enabling everyday purchases at retailers, online platforms, or service providers, would convert speculation into usage.

A user base approaching 100 million daily active wallets, alongside merchant adoption (e.g. point-of-sale DOGE terminals), could generate the transactional volume needed to support a multi-dollar valuation.

Market Sentiment and Community Momentum

Historic DOGE rallies have been driven by viral social media surges and high-profile endorsements.

Renewed, decentralized campaigns, “DogeDays” events, coordinated meme drops, and broad influencer engagement, could rekindle FOMO at scale.

However, reliance on a single celebrity backer is risky; a diversified network of advocates is essential to sustain prolonged buying pressure.

Broad Crypto Bull Run

A robust bull market, characterized by Bitcoin exceeding $100,000, surging institutional inflows, and crypto-friendly regulation, lifts altcoins.

In such an environment, DOGE could ride the tide from $0.50 to $2 or $3, establishing momentum toward $5.

Absent that macro backdrop, DOGE must generate internal catalysts, which is far more challenging.

Technical Breakouts and Chart Formations

Key patterns to watch:

- Cup-and-Handle on monthly charts, targeting $1 first, then higher multiples if volume confirms.

- Ascending Triangle breakout above $0.60 could open the door to $1–$2.

- Gaussian Channel analysis suggests historical trajectory repeats if DOGE re-enters the upper channel band.

- To challenge $5, DOGE must clear successive Fibonacci levels at $1, $2, and $3 with strong volume surges.

Tokenomics and Scarcity Mechanisms

DOGE’s unlimited supply dilutes buying power. Introducing a coin-burn protocol, destroying a percentage of transaction fees, could impose artificial scarcity.

A 10% annual burn might reduce net supply growth by 30%, enhancing upward price pressure if demand holds.

Implementing such a change requires community consensus and technical upgrades.

Regulatory and Institutional Catalysts

Approval of a spot DOGE ETF or formal SEC classification as a commodity would open institutional channels, pension funds, ETFs, and corporate treasuries.

Polymarket odds of ETF approval in 2025 stand above 60%, indicating growing market confidence.

Such a development could inject hundreds of millions in fresh capital, dramatically boosting liquidity and credibility.

Competitive Risks in the Meme-Coin Arena

DOGE competes with Shiba Inu, Pepe, and new meme tokens vying for speculative capital.

Any meme coin offering novel utility (DeFi features, NFTs, governance rights) can siphon attention and funds.

DOGE must leverage its brand to sponsor unique partnerships or decentralized applications, preserving its lead in an overcrowded field.

Tips for Positioning Around DOGE’s $5 Quest

Navigating toward $5 requires disciplined entries, risk controls, and multi-factor confirmation. These tips fuse technical triggers with fundamental checks to help traders and investors time moves and protect capital.

- Focus on Macro Triggers: Increase exposure only when Bitcoin sustains above $100,000 on weekly closes.

- Confirm Chart Breakouts: Enter after DOGE closes above the ascending triangle resistance with volume > 20-day average.

- Watch Burn Proposals: Favor periods when community support for coin burns intensifies, indicating potential scarcity.

- Monitor ETF Developments: Scale in as spot DOGE ETF approval odds exceed 60%.

- Use Protective Stops: Place stops 15% below entry to guard against sudden meme-coin dumps.

- Engage Community Events: Participate in coordinated “DogeDays” to harness collective momentum.

The Possibility of Dogecoin (DOGE) to Hit $5

Dogecoin reaching $5 is a remote, high-risk scenario that hinges on the extraordinary alignment of adoption, market cycles, technical breakouts, tokenomics reforms, and regulatory milestones.

While each catalyst can nudge DOGE upward, only their simultaneous convergence can overcome the steep resistance from current levels to five dollars.

Traders should employ strict risk management, stop-losses, position sizing, and multi-indicator confirmation, and remain vigilant for changing macro conditions.

Price projections vary widely: conservative models place $1 by 2030 and $5 by 2034; bullish cycles and technical surges could accelerate that timeline to 2028–2030 under ideal conditions.