Whale Activity on Binance Drops to Lowest Level Ever

The crypto market is once again showing interesting dynamics, with the activity of large investors (whales) on Binance recording a significant decline.

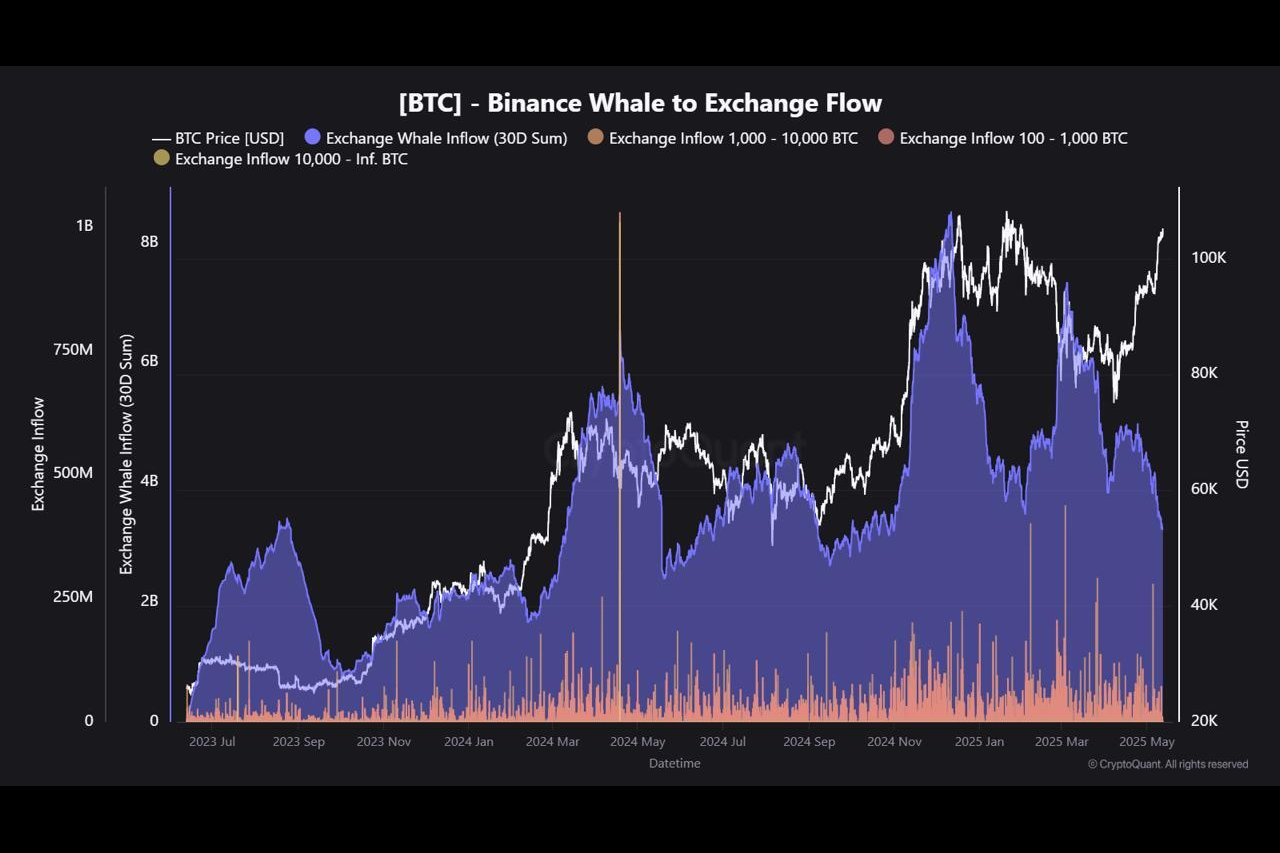

The latest data reveals that the inflow of Bitcoin from whales to this exchange has fallen to its lowest level in the last six months, sparking speculation about their strategy amid the increasing price of Bitcoin that continues to steal attention.

This phenomenon not only reflects changes in investment patterns, but also opens up new opportunities for market movements.

Shrinking Whale Transaction Volume

Based on information we quoted from Beincrypto media, in the last month, the inflow of Bitcoin from large investors (whales) to the Binance platform only reached US$3.27 billion.

This decline indicates reduced selling pressure from large asset holders, with less Bitcoin flowing into the exchange’s order book.

HODL Pattern Increasingly Dominant Among Whales

According to CryptoQuant observer JA Maartunn, a spike in whale inflows occurred in March and November 2024, reaching US$6.17 billion and US$8.44 billion respectively, which led to a price correction when whales took profits.

Now, with minimal deposits to exchanges, whales seem to prefer to store their assets (HODL) or move them to cold storage or over-the-counter transactions. As a result, the supply of Bitcoin on the market is becoming increasingly limited.

Effect on Market Dynamics and Prices

The reduced inflow from whales creates tighter liquidity conditions in the market.

With the sell wall thinning on Binance, the price of Bitcoin has a greater chance of soaring. Market players often see this situation as a sign of optimism.

Recently, the price of Bitcoin has broken through the US$104,000 mark, driven by the absence of large-scale selling.

CryptoQuant data also revealed that the ‘new whales’ group now controls a significant portion of capital, with an average purchase price of US$91,922, indicating higher profit expectations.

Global Economic Factors Still Play a Big Role

Although on-chain indicators show positive signals, the movement of the crypto market remains dependent on macroeconomic conditions.

Traders are advised to continue to monitor global developments that could destabilize the market.