Avalon Labs Just Burned 80M AVL: And It’s Not Just for Show!

Avalon Labs, the DeFi wizard building out a Bitcoin-focused financial utopia, just pulled a spicy move straight out of the crypto playbook—they burned 80 million AVL tokens, instantly nuking 44% of the token’s circulating supply.

But this isn’t just a flashy headline—it’s a calculated chess move to realign tokenomics, tighten the float, and pump the brakes on inflation.

It’s about setting the stage for AVL to become a deflationary darling in a hyper-competitive ecosystem.

Principal Conclusions

Hide-

80 million AVL tokens burned, cutting circulating supply by ~44%.

-

The burn removes unclaimed airdrop tokens, not user-owned assets.

-

This move is part of a deflationary strategy aimed at increasing AVL’s long-term value.

-

Avalon Labs is actively developing a Bitcoin-first DeFi suite with lending, stablecoins, and crypto credit cards.

-

Market response has been positive, with bullish sentiment strengthening around AVL.

Let’s dive deep into what this means for Avalon, the AVL token, and YOU—whether you’re a curious HODLer, a crypto analyst, or just vibing with DeFi’s hottest new tea.

The Burn: A Breakdown Worth Millions

What Exactly Happened?

-

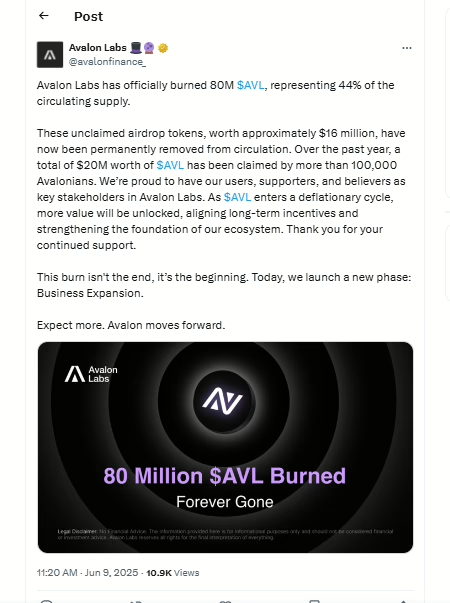

On June 9, 2025, Avalon Labs announced that 80,000,000 AVL tokens were sent to a burn address—aka a black hole in the blockchain universe, where no one can access them again.

-

These AVL tokens were originally part of an airdrop campaign from March 2024, targeting community growth and early user adoption.

-

The catch? Many of those tokens were never claimed, so Avalon turned that dormant supply into a deflationary flex.

How Much Was Burned?

| Metric | Amount |

|---|---|

| Tokens Burned | 80,000,000 AVL |

| Circulating Supply Drop | ~44% |

| Estimated Value Burned | ~$16,000,000 USD |

| Burn Date | June 9, 2025 |

| Source of Tokens | Unclaimed 2024 Airdrop |

Strategy Behind the Smoke: Why Burn Tokens?

Token burns are no random fireworks show. They’re surgical economic moves designed to:

-

Create scarcity: Fewer tokens = more value per token (in theory)

-

Protect long-term holders: Rewarding the diamond hands

-

Reinforce decentralization: Removing centrally controlled, unallocated tokens

-

Boost investor confidence: A bold commitment to AVL’s sustainable growth

Avalon’s head of product even hinted that this was “just the beginning of AVL’s deflationary model,” suggesting a long-game vision for token value preservation.

Avalon Labs: What They’re Building in the Bear or Bull

If you’re wondering what Avalon is cooking, it’s not just token burns and vibes. Their Bitcoin-focused DeFi ecosystem is actually doing the work. Here’s what’s inside their toolbox:

Avalon Ecosystem Breakdown

-

USDa – A BTC-backed Stablecoin

Like USDC, but Bitcoin-powered. Designed for stability with BTC as the ultimate backing asset. -

BTC-Collateralized Loans

Borrow stablecoins without selling your precious Bitcoin. Perfect for bulls who never want to part ways with their BTC stash. -

Crypto Credit Cards

Swipe your crypto, earn rewards, flex at Starbucks. Coming soon. -

Yield-Generating Accounts

Park your coins and watch them grow. Avalon is building infrastructure for passive income, Gen-Z style.

AVL Price Action: Market’s Reaction? Kinda Lit.

Immediately following the burn announcement, AVL’s price ticked up, a sign that the market saw this burn as more than just symbolic.

Reduced supply tends to create bullish pressure, especially when paired with actual utility and community sentiment.

This isn’t guaranteed moon fuel, but it is a classic crypto tactic that often pays off—especially when backed by transparency and product momentum.

Why Token Burns Work (When Done Right)

Let’s pause for a crypto econ 101 moment:

Token Burns Are Like…

-

Share Buybacks in TradFi: Reduce supply = boost remaining value (in theory)

-

Purging Your Closet: Keep what matters, ditch the junk, make your closet (ecosystem) breathable and valuable

-

Decluttering the Blockchain: Removing excess tokens makes the network more efficient and healthy

When Are Burns Effective?

✔️ If tokens were previously claimable but untouched

✔️ If the project has clear value prop & roadmap

✔️ If it signals a long-term growth vision

✔️ If it’s paired with ecosystem traction

Avalon checks all these boxes right now.

Expert Take: Is This All Hype or Actual Impact?

As a crypto analyst, here’s the honest tea:

-

Token burns are not magic bullets, but they can support value if the project is strong.

-

Avalon has active development, real users, and a DeFi suite that aligns with Bitcoin’s ethos.

-

The AVL token now has reduced sell-side pressure and a stronger value narrative.

-

If Avalon can maintain momentum, this burn could be the beginning of a solid multi-year run for AVL—not just a one-time hype cycle.

Wrapping It Up

Avalon Labs didn’t just torch 80M AVL to flex—they’re tightening their tokenomics and setting up a leaner, more sustainable future.

In a sea of overinflated tokens and sketchy supply dynamics, this is the kind of realignment that long-term builders and serious degens alike can respect.

So whether you’re staking, speculating, or just watching from the sidelines, keep an eye on AVL. It’s not just burning tokens—it’s igniting a whole new phase.

Frequently Asked Questions (FAQs)

What is a token burn, again?

A burn means sending crypto to a wallet no one can access, effectively deleting it forever.

Why did Avalon choose to burn these specific tokens?

They were unclaimed airdrop allocations, meaning no one used or needed them—perfect candidates for elimination.

Does this affect AVL’s total supply?

Nope, total supply stays the same. But circulating supply dropped massively, which is what impacts short- to mid-term price action.

Is AVL now deflationary?

It’s moving in that direction. This burn marks the start of a longer-term deflationary strategy.

Should I buy AVL now?

Not financial advice, fren. But keep your research hat on—AVL’s fundamentals are looking more solid than ever.