Binance Research Highlights Crypto ETF Filings and Record Token Growth

Binance has released its latest Monthly Market Insights report. According to the findings, January 2025 saw significant growth in meme coins and ETF applications.

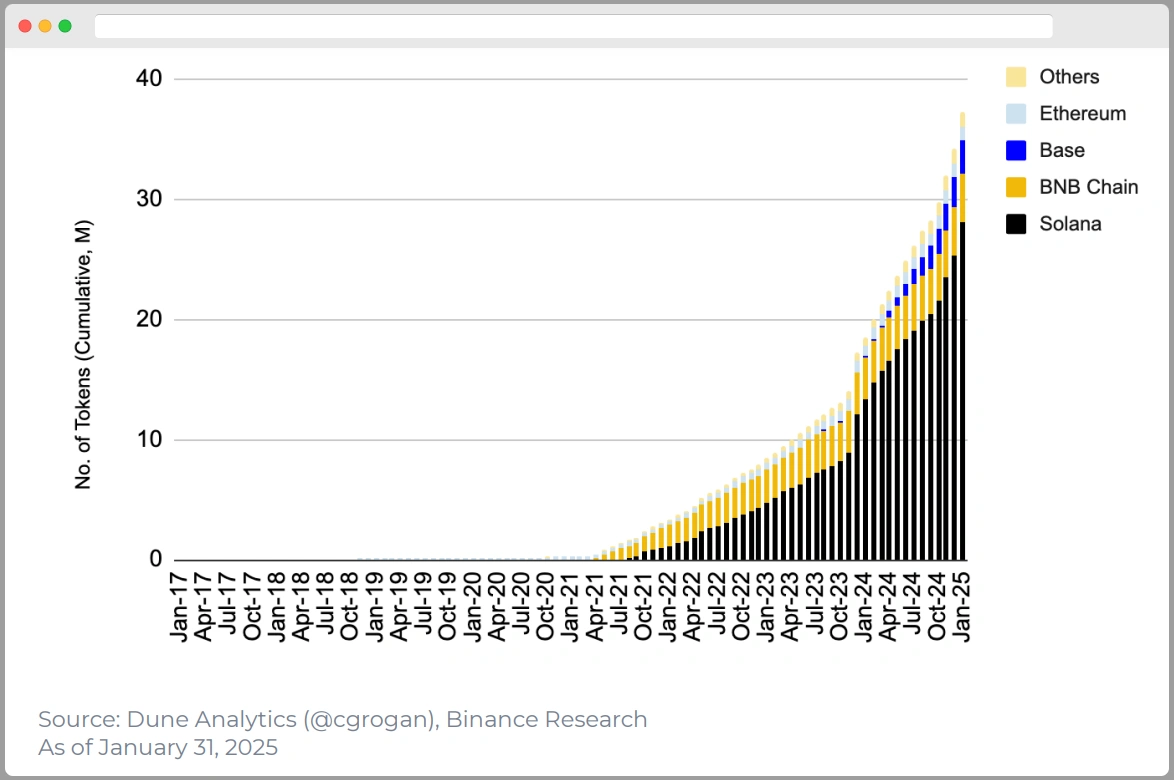

The total number of tokens in circulation has surpassed 37 million, with Solana leading the way in token launches.

Additionally, there are currently 47 active crypto ETF filings in the U.S. The overall market performed strongly, but AI-related crypto projects suffered substantial losses, primarily due to DeepSeek’s impact.

Key Takeaways:

Show

Binance Research: Examining Meme Coins, ETFs, and AI Tokens

As the research arm of the world’s largest crypto exchange, Binance Research has provided an optimistic outlook on the industry’s trajectory.

The report notes that the market reached a peak valuation of $3.76 trillion in January, with meme coins playing a pivotal role in this expansion.

“The advent of token launchpads and the memecoin mania has led to the creation of over 37M tokens, with projections exceeding 100M by year-end. This growth has fragmented capital, making it harder for tokens to sustain prices and achieve high valuations,” the report stated.

While meme coins continue to drive industry-wide growth, Binance Research also flagged potential concerns.

The report aligns with broader analyses suggesting that this influx of new tokens is diverting capital and attention away from traditional altcoins.

“This explosive growth in tokens has several implications. Firstly, capital is increasingly fragmented and distributed across a greater number of tokens. With low switching costs, it will be harder for tokens to sustain prices and command high valuations. Many parts of the market may also struggle to see explosive returns on a sustainable basis. Additionally, the constant influx of new tokens has fueled speculation, prompting traders to chase the next trending token or emerging narrative with potential for growth. This behavior reduces attention spans and disincentivizes long-term holding,” Binance Research explained.

The Impact of Meme Coin Growth on Market Dynamics

Binance noted that the surge in meme coin creation has intensified speculative behavior, shortening investors’ attention spans and discouraging long-term holding.

Despite most of these tokens holding minimal market capitalization, the trend has driven notable benefits, such as a substantial increase in Solana DEX volumes.

In January alone, meme coins and AI-driven trading activity helped push the Solana-to-Ethereum DEX volume ratio beyond 300%.

The ETF Rush Following Political Shifts

The report also explored political changes following Donald Trump’s inauguration.

With Gary Gensler stepping down as SEC Chairman, the regulatory landscape shifted dramatically, leading to a wave of ETF applications.

Binance Research reports that 47 ETF applications are currently active in the U.S., covering 16 asset categories—including meme coins.

AI Tokens Face Setbacks Despite Broader Market Gains

Overall, Binance Research concluded that January was a positive month for the cryptocurrency industry.

However, AI-focused crypto assets suffered notable losses, with DeepSeek significantly impacting the niche sector.

Despite this downturn, the DeFAI sector managed to recover to some extent, closing the month with a -10% return.

Compared to the initial declines, this rebound indicated that the losses could have been far worse.