How Much Will 1 Ethereum Be Worth in 2025?

Forecasting how much 1 Ethereum will be worth in 2025 requires a comprehensive analysis of various factors.

However, expert predictions vary widely, some expect ETH to stay low on the bear market, while others remain bullish on its prospects this year.

In this article, we will explore the key factors influencing Ethereum’s price and the potential narratives shaping its price action.

Key Takeaways:

Hide- Changelly: Their analysis indicates that Ethereum could dip to around $1,966.15 in March 2025, with a possible peak near $2,306.07 during the same month.

- Other estimates from the same source suggest potential highs reaching about $7,194.28. (Source: Changelly)

- Crypto Rover (CoinCentral): Crypto analyst Crypto Rover is notably bullish, predicting that Ethereum might “teleport over $15,000” during the current market cycle. (Source: CoinCentral)

- Coinbase Analysis: A series of insights from Coinbase indicate significant upward momentum:

- One forecast positions ETH at a robust $12,000 by the end of 2025.

- Dhungana’s analysis projects Ethereum could soar as high as $8,000 by May 2025.

- Steno Research, meanwhile, anticipates a rise from around $3,300 to roughly $8,000, drawing on historical trends.

- Market Caution: Despite the optimism, some analysts believe that Ethereum could struggle in 2025 and may underperform compared to Bitcoin, reflecting ongoing uncertainties in the crypto market.

Current State of Ethereum

Ethereum today is a dynamic ecosystem marked by rapid technological progress and evolving market dynamics.

The ongoing upgrade from proof-of-work (PoW) to proof-of-stake (PoS) aims to address issues like transaction speed, cost, and energy consumption.

Additionally, the integration of layer-2 solutions is reducing on-chain congestion and enhancing user experience.

Concurrently, booming sectors like DeFi and non-fungible tokens (NFTs) have expanded Ethereum’s use cases, although the market remains sensitive to regulatory and macroeconomic factors.

This blend of innovation and uncertainty positions Ethereum as both a technological pioneer and a high-stakes investment asset.

Historical Price Trends

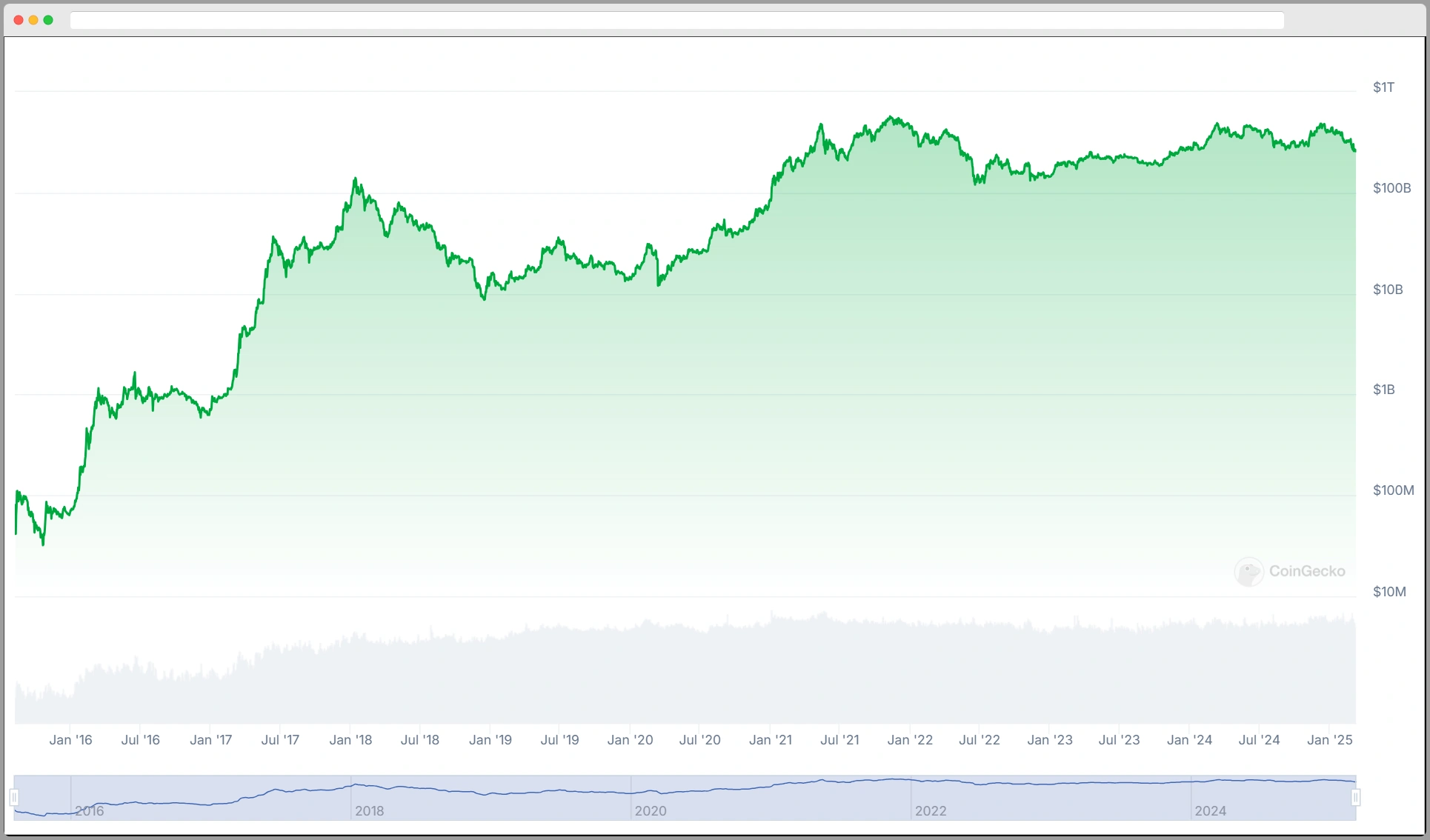

Ethereum’s price history is characterized by rapid growth and significant volatility:

- 2015 Launch: Began trading at approximately $0.70.

- 2017 Surge: Prices soared to around $1,400 amid the ICO boom.

- 2018 Correction: The market saw a sharp decline, with prices dropping to near $80.

- 2020 Resurgence: Renewed interest from DeFi and NFTs pushed prices above $700.

- 2021 Peak: Ethereum reached an all-time high of over $4,800 in November.

These fluctuations underscore the influence of market sentiment and external factors on Ethereum’s price.

Influential Factors on Ethereum’s Future Price

Several key dynamics are expected to shape Ethereum’s market value by 2025:

- Market Sentiment: Investor behavior, driven by both hype and caution, can cause dramatic price shifts.

- Regulatory Developments: Changes in legal frameworks could either spur innovation or inhibit growth.

- Macroeconomic Factors: Broader economic trends, such as inflation and interest rates, affect the attractiveness of cryptocurrencies relative to traditional assets.

- Network Activity: Metrics such as transaction volumes and active users serve as indicators of demand.

- Competitive Innovations: Advancements by rival platforms can influence investor preferences and market share.

Technological Innovations Shaping Ethereum

Ethereum 2.0 Upgrades

The transition to Ethereum 2.0 brings major improvements:

- Proof of Stake (PoS): Lowers energy consumption and enhances network security.

- Shard Chains: Distributes network load to boost scalability.

- Beacon Chain: Orchestrates the coordination of PoS and shard chains.

- Enhanced Security & EIP-1559: Optimizes gas fees and fortifies transaction reliability.

Layer-2 Solutions

Layer-2 innovations are critical in addressing transaction bottlenecks:

- Rollups: Aggregate transactions off-chain to reduce on-chain load.

- State Channels: Enable near-instant transactions through off-chain processing.

- Sidechains & Plasma: Offer customizable, scalable environments.

- zk-Rollups: Provide enhanced privacy and secure, cryptographic validation.

DeFi Innovations

Ethereum’s ecosystem is further expanded by the rapid evolution of DeFi:

- Automated Market Makers (AMMs): Enhance liquidity and trading efficiency.

- Cross-Chain Interoperability: Enables seamless transactions across different blockchain networks.

- Decentralized Lending & Tokenization: Open new avenues for investment and asset management.

- Enhanced Governance Models: Empower users to influence platform development.

Market Sentiment and Investor Behavior

Positive sentiment, driven by strong technological progress and favorable economic indicators, can drive up buying activity.

Conversely, negative sentiment, triggered by regulatory crackdowns or economic downturns, can prompt swift sell-offs.

| Factor | Positive Sentiment | Negative Sentiment |

|---|---|---|

| Market Trends | Increased buying activity | Heightened selling pressure |

| Technological Advancements | Rising adoption rates | Stagnation in development |

| Economic Indicators | Favorable macro conditions | Economic downturns |

| Community Engagement | Active governance participation | Apathy toward development |

Competition and Market Position

Ethereum faces increasing competition from platforms such as Binance Smart Chain, Solana, Cardano, Polkadot, and Avalanche.

Despite these challenges, Ethereum’s strengths lie in its robust developer community and extensive ecosystem of dApps and DeFi projects.

Unique Advantages:

- Pioneering Role: As the first platform to support smart contracts, DeFi, and NFTs, Ethereum has established a resilient foundation.

- Ongoing Innovation: Continuous technological upgrades, including the shift to PoS and evolving smart contract capabilities, enhance its market position.

Future innovations in interoperability, sustainability, and smart contract evolution will be crucial for maintaining Ethereum’s competitive edge.

Expert Predictions and Analysis

Analysts offer diverse views on Ethereum’s future:

- Optimistic Outlook: Some experts predict significant price increases up to $15,000, driven by an expanding ecosystem and robust DeFi or NFT markets.

- Cautious Perspective: Others warn that volatility and regulatory uncertainties may temper growth, projecting a price range between $1,000 and $2,000 by 2025.

The overall market trajectory will depend on Ethereum’s ability to innovate and adapt amid evolving competitive and regulatory landscapes.

Investment Strategies

Investing in Ethereum requires a balanced, strategic approach:

- Diversification: Combine Ethereum with other asset classes to spread risk.

- Long-Term Holding: Consider a buy-and-hold strategy to capitalize on future growth.

- Continuous Research: Stay informed on technological and regulatory updates.

- Risk Management: Set clear investment limits and exit strategies.

- Dollar-Cost Averaging: Invest fixed amounts at regular intervals to mitigate market volatility.

Final Word

Ethereum’s journey into 2025 is a blend of tech innovation, market sentiment, and regulatory frameworks, offering significant promise and inherent uncertainties.

Expert forecasts vary widely, with predicting ETH will stay lows around $2,306.07 and remains bullish with projections over $15,000. However, market caution persists as some analysts warn Ethereum might underperform relative to Bitcoin.

The significant market volatility and uncertainty mean that investors must remain agile and well-informed, continuously tracking all crucial factors that will influence how much 1 Ethereum will be worth in 2025.