How to Stake Ethereum in 2025

How to Stake Ethereum – Staking Ethereum is one of the most popular methods to earn passive income while helping to secure the blockchain network.

As Ethereum transitions to a Proof of Stake (PoS) consensus mechanism, staking Ethereum has become an increasingly discussed topic among cryptocurrency enthusiasts.

In this guide, we will walk you through how to stake Ethereum, covering the methods, benefits, risks, and tax implications that you need to understand.

Summary Key Takeaways

ShowWhat is Staking Ethereum?

Before diving into how to stake Ethereum, it’s essential to understand what staking Ethereum is.

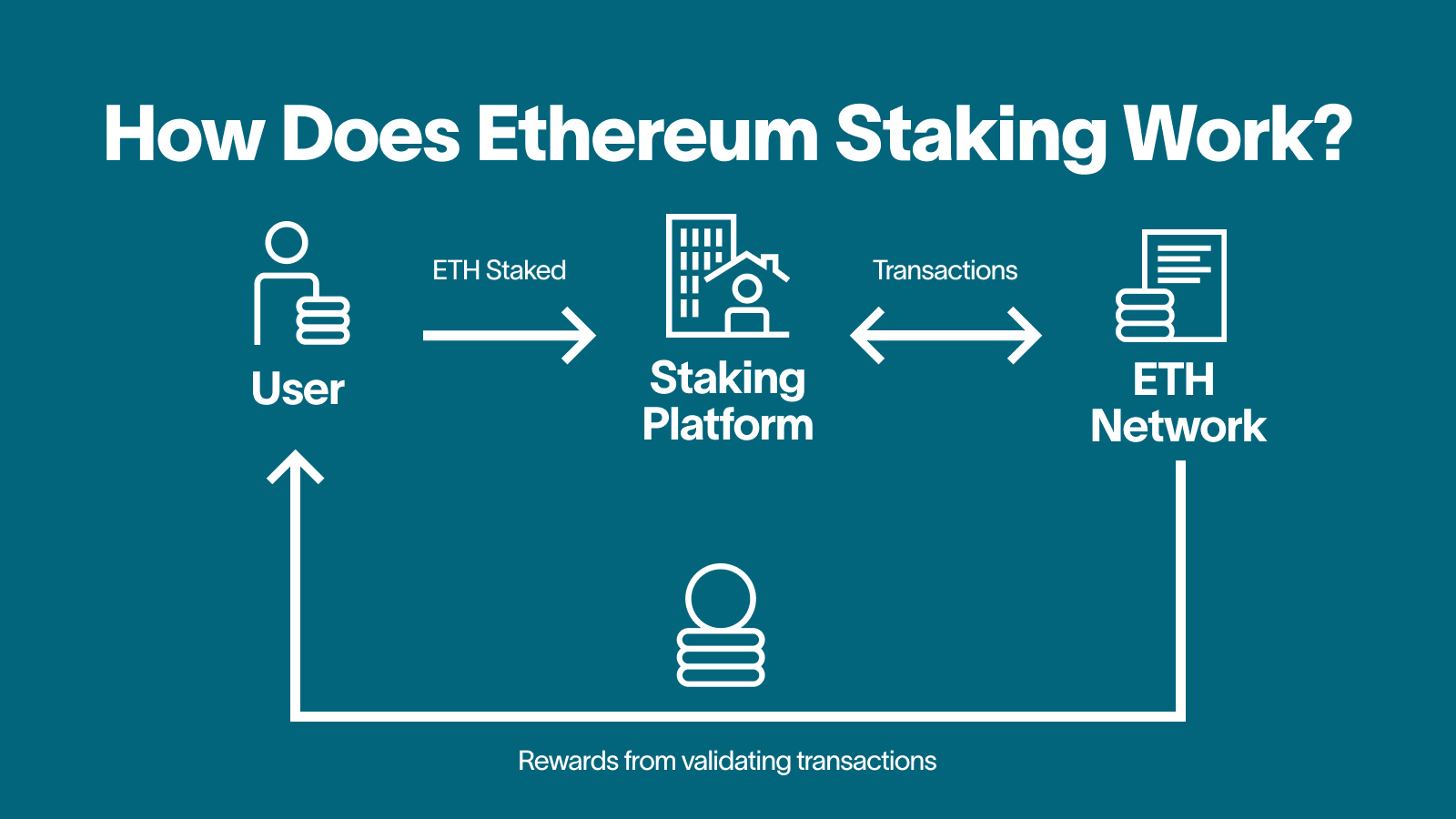

According to Cryptomaniaks, staking Ethereum involves locking a certain amount of Ether (ETH) to support the operations of the Ethereum blockchain.

Under the PoS mechanism, staking crypto replaces the mining process used in the previous Proof of Work (PoW) model. Validators validate transactions and add new blocks to the blockchain by locking their ETH as collateral.

Staking ETH not only strengthens the network but also provides staking rewards. The more ETH you stake, the greater your chance of earning these rewards.

Methods for Staking Ethereum

There are several methods for how to stake ETH, each with its advantages and disadvantages:

1. Running Your Own Validator Node

This method requires setting up hardware and software to run a validator node, requiring a minimum of 32 staking ETH to get started.

- Advantages: Full control over your assets.

- Disadvantages: Requires technical expertise, stable internet connectivity, and hardware investment.

2. Using a Cryptocurrency Exchange

Platforms like Binance or Coinbase offer easy-to-use staking crypto services. You simply transfer your ETH to the exchange, and they handle the entire ETH staking process for you.

- Advantages: Convenient and doesn’t require technical setup.

- Disadvantages: You give up control of your assets to a third party, which introduces security risks.

3. Joining a Staking Pool

Staking pools allow multiple users to combine their ETH to meet staking requirements.

- Advantages: Participation with a smaller amount of ETH.

- Disadvantages: Service fees are charged by the pool provider.

Steps to Start Staking Ethereum

To begin, follow these steps for how to stake Ethereum effectively:

1. Choose a Reputable Staking Platform

The first step in staking Ethereum is selecting a safe and trustworthy platform. Ensure the platform has good user reviews, operational transparency, and responsive customer support.

2. Transfer ETH to the Selected Platform

After choosing your platform, transfer your ETH to a wallet connected to the staking service. Follow the platform’s procedures carefully to ensure your funds’ security.

3. Understand Minimum Requirements and Lock-up Periods

Each staking method has a minimum ETH staking requirement. Additionally, be aware of the lock-up duration, during which your staked ETH cannot be withdrawn.

Benefits and Risks of Staking Ethereum

Staking crypto can be rewarding but also carries certain risks. Here’s what you need to consider before you start staking ETH:

Benefits of Staking

- Passive Income: ETH staking allows you to earn rewards without selling your ETH.

- Contribution to the Network: By staking, you help improve the security and efficiency of the Ethereum network.

Risks of Staking

- Security Vulnerabilities: If using third-party services, your assets may be at risk of hacking or misuse.

- Lack of Liquidity: Staked ETH cannot be withdrawn during the lock-up period, which can be a problem if you need immediate access to funds.

Tax Implications of Staking Ethereum

As a way to earn passive income, staking Ethereum has tax implications that participants should be aware of.

Rewards earned from staking crypto are not only considered income but can also affect your tax liabilities when selling or trading staked ETH.

1. Taxes on Staking Rewards

Staking rewards are taxable as income at the time they are received. You must report these rewards in your annual tax return.

2. Taxes on Capital Gains

If you sell or exchange staked ETH, any profits from the transaction will be subject to capital gains tax. The tax rate depends on the holding period and local tax regulations.

3. Importance of Accurate Record-Keeping

Maintain detailed records of your staking crypto activities, including rewards received and the dates they were earned. This will simplify tax reporting in the future.

How to Stake is Easy – Start Investing

Staking Ethereum is an excellent way to earn passive income while contributing to the Ethereum blockchain.

However, before starting, it’s crucial to understand the available staking methods, associated risks, and tax implications. With thorough research and by choosing a reliable platform, you can safely and efficiently begin your ETH staking journey.

Use this guide on how to stake Ethereum as your first step into the world of staking crypto and take advantage of the exciting investment opportunities it offers.

Frequently Asked Questions (FAQs)

What is Ethereum staking?

Ethereum staking is the process of locking up a certain amount of Ether (ETH) to support the operation of the Ethereum blockchain network and earning rewards in the form of staking. This staking is done on the Proof of Stake (PoS) mechanism, replacing mining on the Proof of Work (PoW) model.

What are the advantages and risks of staking Ethereum?

Benefits:

Passive income from staking rewards.

Contributing to the security and efficiency of the Ethereum network.

Risks:

Potential hacking if using third-party services.

Lack of liquidity as staked ETH is locked for a certain period.

What is the minimum amount of ETH required for staking?

To run your own validator node, you will need a minimum of 32 ETH. If that amount is not enough, you can use a staking pool or exchange platform to stake smaller amounts.