Is Owning 1 Bitcoin Enough?

Owning one Bitcoin may not be enough for financial security due to its extreme volatility and unpredictable future value.

Although Bitcoin’s maximum supply creates scarcity, market corrections can greatly impact prices.

Investors should consider their risk tolerance and financial goals when evaluating their cryptocurrency holdings.

Additionally, as institutional interest grows, Bitcoin’s role may evolve in investment portfolios.

Understanding these dynamics can provide deeper insights into effective investment strategies and potential returns.

Key Takeaways:

ShowThe Current State of Bitcoin’s Market Value

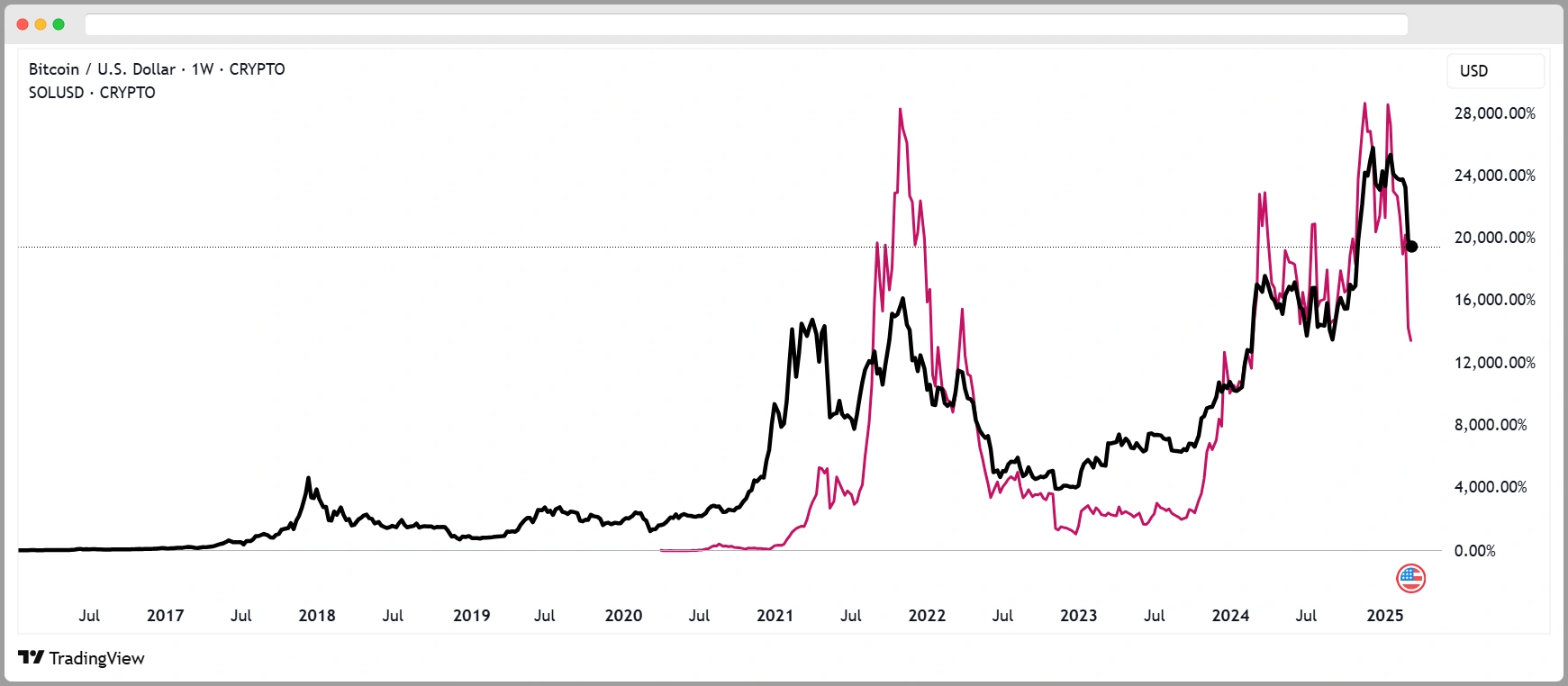

How has Bitcoin’s market value evolved in recent years? Bitcoin has experienced significant fluctuations, marked by periods of rapid growth and sharp declines.

From its humble beginnings, Bitcoin’s price surged to an all-time high of over $64,000 in April 2021, driven by increased institutional adoption and retail interest.

However, by the end of 2022, the market witnessed a correction, with Bitcoin trading below $20,000.

This volatility reflects both macroeconomic factors, such as inflation and regulatory scrutiny, and internal market dynamics, including supply constraints and speculative trading.

By late 2022, Bitcoin’s correction saw prices dip below $20,000, influenced by inflation and regulatory concerns.

As of October 2023, Bitcoin’s market value remains a focal point for investors, indicating a complex interplay of confidence, skepticism, and the evolving landscape of digital currencies.

In early 2024, Bitcoin bounced back as institutional interest grew and new products like spot Bitcoin ETFs got approved.

By March 2024, its price broke past $70,000 on many exchanges, sparking renewed market optimism.

Later that year, in November 2024, positive political events, including the re-election of a crypto-friendly U.S. president, and continued institutional support pushed Bitcoin to record highs, with its price briefly exceeding $100,000.

By early 2025, Bitcoin has settled into a stable phase, trading in the mid- to high-$90,000 range as investors rebalance their portfolios and take profits.

Despite minor pullbacks amid ongoing economic uncertainties, many remain cautiously optimistic about its long-term outlook.

Understanding Bitcoin’s Role as a Store of Value

While traditional currencies are often subject to inflation and government policy, Bitcoin has emerged as a potential alternative store of value, appealing to those seeking a hedge against economic instability.

Its decentralized nature and limited supply make it an attractive option for investors. Key factors influencing Bitcoin’s status as a store of value include:

- Scarcity: With a maximum supply of 21 million coins, Bitcoin’s inherent scarcity contrasts sharply with fiat currencies, which can be printed at will.

- Decentralization: Operated on a blockchain, Bitcoin is not governed by a single entity, reducing risks associated with centralized banking systems.

- Historical Performance: Over the past decade, Bitcoin has demonstrated significant price appreciation, further solidifying its reputation as a potential long-term store of value.

The Potential Impact of Future Bitcoin Adoption

The ongoing evolution of Bitcoin as a store of value sets the stage for its potential widespread adoption in various economic contexts.

As institutional interest grows, evidenced by significant investments from companies and hedge funds, the perception of Bitcoin shifts from a speculative asset to a legitimate financial tool.

Data from recent surveys indicate that over 60% of financial professionals foresee Bitcoin becoming a mainstream asset within a decade.

Additionally, the increasing integration of Bitcoin into payment systems and financial services enhances its utility and acceptance.

If adoption trends continue, Bitcoin could stabilize in value, reducing volatility, thereby attracting a broader demographic of investors.

This trajectory suggests that owning Bitcoin may not only be advantageous but essential in future diversified investment portfolios.

Comparing Bitcoin to Other Investment Opportunities

Numerous investment opportunities exist in today’s financial landscape, each presenting unique risk and return profiles.

Investment opportunities abound today, each with distinct risk and return characteristics to consider.

Bitcoin, often seen as a digital gold, offers a distinctive asset class compared to traditional investments. When evaluating its merits, several factors come into play:

- Volatility: Bitcoin’s price can fluctuate dramatically within short periods, unlike more stable assets.

- Liquidity: Bitcoin provides high liquidity, allowing for quick conversion to cash, whereas real estate or collectibles may take longer to sell.

- Regulatory Environment: The evolving legal landscape surrounding cryptocurrencies can impact Bitcoin’s performance differently than stocks or bonds, which are more established.

Investors must weigh these factors against traditional assets to determine if Bitcoin aligns with their investment strategy and risk tolerance.

Personal Financial Goals and Investment Strategies

As individuals define their personal financial goals, the alignment of these objectives with investment strategies becomes essential for successful wealth accumulation.

A thorough understanding of risk tolerance, time horizon, and liquidity needs is critical when integrating Bitcoin into one’s portfolio.

Recent data indicates that Bitcoin’s volatility can yield significant returns, but it also poses substantial risks.

For instance, investors aiming for long-term growth may allocate a smaller percentage to Bitcoin, balancing it with more stable assets.

Conversely, those with aggressive goals might invest more heavily, accepting higher risk for potential higher rewards.

All in all, creating an investment plan that meshes your personal financial goals with the realities of the market can boost your chances of success while also keeping the risks of cryptocurrency investments in check.

Wrapping Up

In the intricate tapestry of investment landscapes, owning one Bitcoin may serve as a mere thread, but its potential impact can be profound.

As Bitcoin continues to evolve, its role as a digital gold and a hedge against economic uncertainty beckons attention.

However, the decision to invest transcends mere ownership; it intertwines with individual financial aspirations and the broader currents of market dynamics.

Consequently, one Bitcoin may be a stepping stone, yet the path to financial mastery requires a broader vision.