What Is the Most Powerful Coin After Bitcoin?

Ethereum shines as Bitcoin’s closest rival, boasting a $269B market cap and driving innovation in decentralized apps and finance.

Whether you’re an investor, developer, or crypto enthusiast, here’s why Ethereum secures the #2 spot in the crypto world.

Key Takeaways:

Hide- Ethereum’s Market Standing Is Robust: As of June 2025, Ethereum’s market capitalization is $269 billion—about 12.8 % of Bitcoin’s $2.1 trillion—together accounting for over 70 % of the $3.27 trillion crypto market, underscoring Ethereum’s position as the leading programmable blockchain.

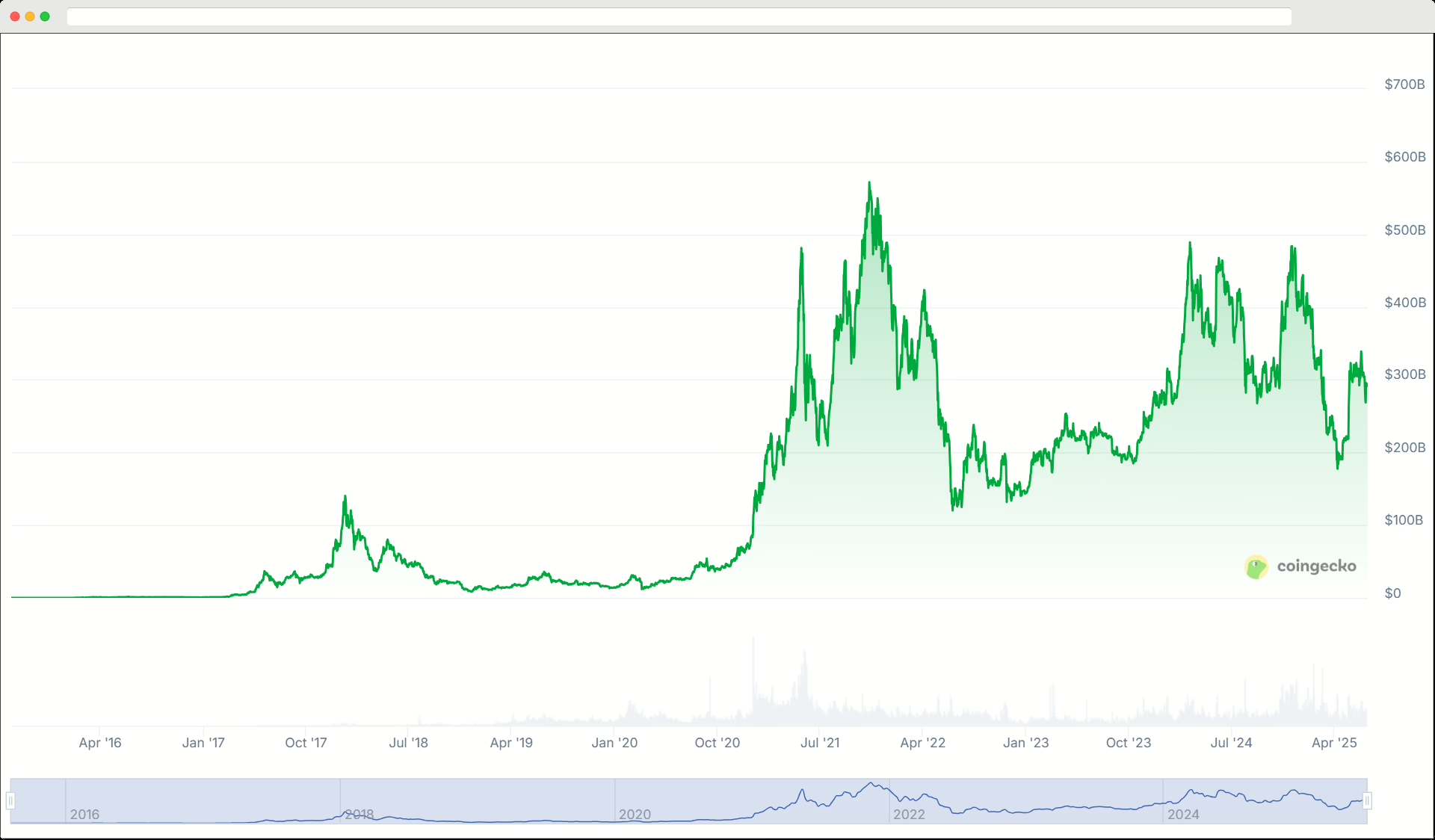

- Sustained Growth Since Launch: From a negligible cap at its July 2015 launch, Ethereum surged to $10 billion by the 2017 ICO boom, peaked at $400 billion during the 2021 DeFi/NFT frenzy, and has since stabilized between $200 billion and $350 billion through mid-2025, reflecting durable investor confidence.

- High Network Activity Despite Maturity: With roughly 400,000 daily active addresses and 1.3 million transactions per day in June 2025—up 3.5 % over last year—Ethereum continues to outpace nearly all competitors, even though on-chain activity remains below its 2021 highs.

- Pioneering Smart-Contract Platform: Ethereum’s introduction of the EVM and Solidity smart contracts transformed blockchains into general-purpose platforms, enabling the creation of tokens, DAOs, and decentralized applications spanning finance, gaming, and beyond.

- Energy-Efficient Securing via The Merge: Transitioning to Proof of Stake in 2022 (“The Merge”) slashed Ethereum’s energy consumption by 99.9 % and reduced new ETH issuance by 90 %, requiring validators to stake 32 ETH and paving the way for scalable, eco-friendly consensus.

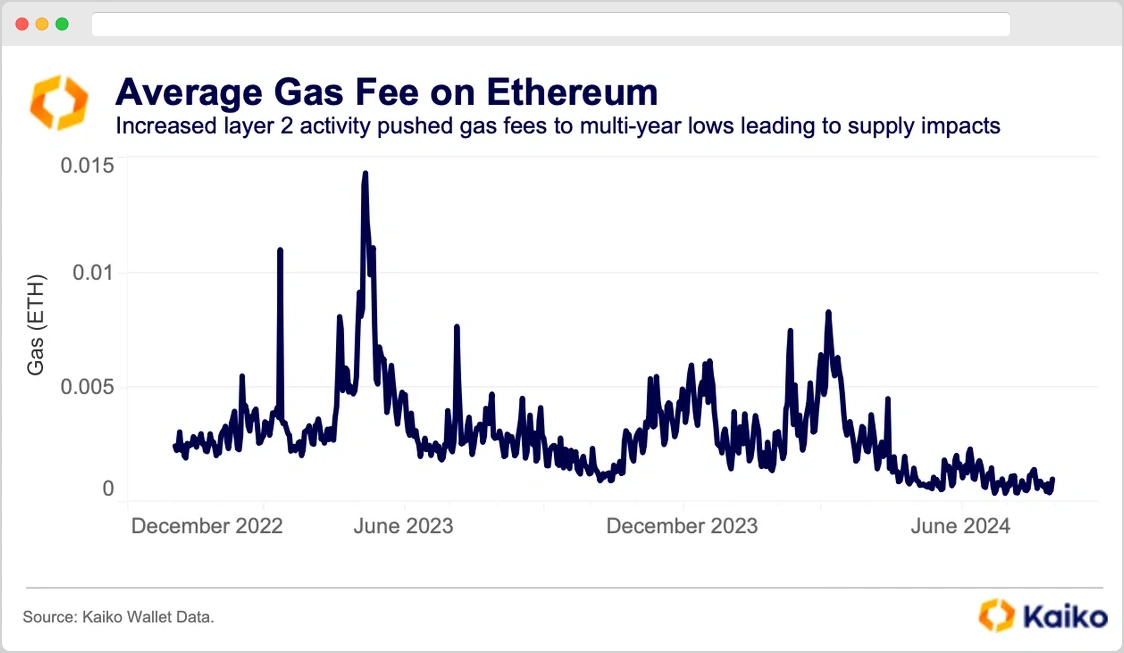

- Layer-2 Rollups Drive Mass Adoption: Solutions like Optimism and Arbitrum bundle transactions off-chain to cut fees by up to 90 % and boost throughput into the hundreds of TPS, while emerging ZK-Rollups (e.g., zkSync) promise further speed and cost improvements, keeping Ethereum competitive.

- Core Use Cases Power Growth: Decentralized finance locks $150 billion in smart contracts (with Uniswap handling ~1 million daily swaps and Aave providing lending pools), NFTs generated $1.8 billion in sales in 2024, and DAOs—over 10,000 globally—manage $21 billion in assets, showcasing Ethereum’s vital role in crypto innovation.

- Competitive But Unmatched Ecosystem: While rivals such as BNB (exchange-tied), Cardano (rigorous but slower), Solana (ultra-fast but centralized risk), Polkadot (cross-chain focus), and Avalanche (high TPS yet smaller DeFi presence) vie for market share, Ethereum’s extensive developer base and Layer-2 expansion maintain its lead.

- Ongoing Challenges and Roadmap: Persistent gas fees ($10–$50 at peaks) and base-layer throughput limits (15–30 TPS) remain issues until full sharding (2026) and Proto-Danksharding (2025) roll out. However, Ethereum’s robust upgrade roadmap aims to deliver tens of thousands of TPS while preserving decentralization.

- Positive Long-Term Outlook: Layer-2 total value locked has surged 205 % in 2025 to $62 billion, institutional interest via ETH ETFs launched in 2024 grows, and analysts forecast ETH prices of $4,000–$8,000 by end-2025 and up to $22,000 by 2030, reflecting confidence in Ethereum’s evolving infrastructure and adoption.

Which Coin Reigns After Bitcoin? A Deep Dive into Ethereum

Ethereum (ETH) isn’t just a cryptocurrency—it’s the backbone of a thriving ecosystem powering DeFi, NFTs, and more. Can it challenge Bitcoin’s dominance?

This article explores Ethereum’s market strength, technological edge, key use cases, competitors, challenges, and future potential.

1. The Market Cap and Dominance of Ethereum

Ethereum’s market cap stands at $269B in June 2025, about 12.8% of Bitcoin’s $2.1T. Together, they command over 70% of the $3.27T crypto market, showcasing Ethereum’s heavyweight status.

Historical growth trajectory since launch in 2015

Since its July 2015 launch, Ethereum’s market cap skyrocketed from millions to a 2021 peak of $400B, fueled by ICOs, DeFi, and NFTs. After a 2022 dip, it stabilized at $200–$350B by 2025, rewarding investors and powering dApp innovation.

- 2015: Launched with a tiny market cap.

- 2017: Hit $10B during the ICO boom.

- 2021: Peaked at $400B amid DeFi/NFT craze.

- 2023–2025: Held steady at $200–$350B.

On-chain metrics: active addresses, transaction volume

Ethereum buzzes with over 400,000 daily active users and 1.3M transactions in June 2025, up 3.5% from last year. Though down 43% from 2021 peaks, these figures dwarf most rivals, reflecting strong DeFi and NFT activity.

2. Ethereum’s Technological Advantages

Smart Contract Platform Pioneer

Ethereum revolutionized crypto by introducing smart contracts, turning blockchains into platforms for apps like games and finance.

Its Ethereum Virtual Machine (EVM) runs these contracts reliably across the network, using languages like Solidity to power tokens and DAOs.

Transition to Proof of Stake (The Merge)

In 2022’s “The Merge,” Ethereum switched to Proof of Stake, slashing energy use by 99.9% (from 11M tonnes CO₂e to under 1,000 tonnes) and cutting ETH issuance by 90%.

Validators lock 32 ETH to secure the network, making it greener and more accessible than Bitcoin’s mining. This shift paves the way for future scaling.

Layer-2 Scaling Solutions (Optimism, Arbitrum, and Beyond)

Layer-2 rollups like Optimism and Arbitrum bundle transactions off-chain, cutting fees by up to 90% and boosting speeds to hundreds of TPS.

Swapping tokens on Optimism costs pennies, not dollars. Emerging ZK-Rollups like zkSync promise even faster transactions, keeping Ethereum competitive.

3. Key Use Cases Driving Ethereum’s Growth

Ethereum powers the crypto economy, from lending billions to minting digital art. Its key use cases—DeFi, NFTs, and DAOs—cement its leadership.

Decentralized Finance (DeFi): Lending, Derivatives, Automated Market Makers

Ethereum dominates DeFi, with $150B locked in smart contracts by mid-2025.

AMM from Uniswap enables instant token swaps without banks, handling 1M trades daily.

Lending pools from AAVE offer loans without intermediaries, deepening Ethereum’s financial ecosystem.

Non-Fungible Tokens (NFTs): Digital Art, Gaming, Metaverse Collectibles

Ethereum’s NFT standards power digital ownership, with 2024 sales hitting $1.8B.

NFT platforms like OpenSea lead, from Bored Apes to virtual land in Decentraland. NFTs redefine value for art, gaming, and metaverse assets.

Decentralized Autonomous Organizations (DAOs) and Governance Frameworks

DAOs enable community-run projects via blockchain voting. Over 10,000 DAOs manage $21B in assets, with Uniswap DAO steering protocol upgrades, showcasing Ethereum’s role in decentralized governance.

4. Comparative Analysis with Other Altcoins

Ethereum faces competition but leads with its vast ecosystem.

- BNB: Tied to Binance’s exchange, offering fee discounts but less decentralized.

- Cardano: Emphasizes academic rigor and security, but slower than Ethereum’s rollups.

- Solana: Hits 65,000 TPS, but risks outages and centralization.

- Polkadot: Enables cross-chain communication, yet lacks Ethereum’s dApp depth.

- Avalanche: Offers 4,500 TPS and sub-second finality, but smaller DeFi presence.

Ethereum’s developer community and Layer-2 scaling keep it ahead.

5. Challenges and Criticisms Facing Ethereum

Ethereum faces hurdles, but solutions are in progress.

Persistently High Gas Fees During Network Congestion

Transaction costs can hit $10–$50 during peak times, pricing out small transfers. Layer-2 rollups like Arbitrum cut costs by 90%, and future upgrades promise more savings.

Scalability Limitations Ahead of Full Sharding Rollout

Ethereum’s Layer-1 handles 15–30 TPS, but sharding by 2026 could boost this tenfold. Proto-Danksharding in 2025 will lower data costs for rollups, easing scalability issues.

Competition from Cheaper, Faster Alternatives

Rivals like Solana (65,000 TPS) and Avalanche (4,500 TPS) offer low fees but face centralization risks. Ethereum’s robust ecosystem and Layer-2s maintain its edge.

6. The Future Outlook: Ethereum 2.0 and Beyond

Sharding Roadmap and Expected Performance Improvements

Proto-Danksharding in 2025 will cut Layer-2 fees by 90%, with full Danksharding by 2026 enabling tens of thousands of TPS, keeping Ethereum scalable and decentralized.

Continued Growth of Layer-2 Ecosystems

Layer-2s like Arbitrum and Base hold $62B in TVL, up 205% in 2025. With sub-second transactions and low fees, they’re expanding DeFi and AI-powered dApps.

Institutional Adoption and Regulated Financial Products

Ethereum ETFs, approved in 2024, drive institutional investment. With 83% of investors eyeing crypto in 2025 (EY-Parthenon), custodians like Deutsche Boerse now offer ETH services.

Price Predictions by Analysts and Firms

Analysts predict ETH’s rise:

- 2025: Steno Research projects ETH could rise to at least $8,000. While Standard Chartered has a more conservative target of $4,000 by year-end.

- 2030: On the mid-term views, VanEck analysts estimate a long-term fair value of $11,800 by 2030. Their follow-up the outlook raises a scenario of $22,000 by 2030 under accelerated institutional ETF inflows.

- 2040 & 2050: On the long-term outlook, especially by 2040, some analyst seen ETH could be between $6,710 and $25,438, depending on deflationary burn rates and rollup adoption; by 2050, the spectrum widens to $6,027–$149,806 under aggressive DeFi expansion assumptions.

Wrapping Up: Why Ethereum Holds the Crown

Ethereum, with a $269B market cap and $150B in DeFi, powers crypto’s future through smart contracts, NFTs, and DAOs. Its eco-friendly Proof of Stake and Layer-2 rollups ensure it stays ahead. As analysts eye $8,000 by 2025, Ethereum remains crypto’s innovation hub. Try its dApps or track its roadmap to join the revolution!