What Is a Gas Fee in Cryptocurrency?

A gas fee in cryptocurrency is a payment made to miners or validators for processing and validating transactions on a blockchain network.

This fee reflects the computational effort needed to execute transactions or smart contracts.

Gas fees, denominated in a blockchain’s native cryptocurrency, vary with network congestion and transaction complexity.

Influenced by factors like transaction volume and market dynamics, they significantly affect cost and speed.

Understanding gas fees and comparing blockchain platforms is essential for optimizing transaction efficiency and expenses.

Key Takeaways:

ShowGas Fees Definition

Gas fees are mandatory payments within cryptocurrency networks, covering the computational resources needed to execute transactions or smart contracts.

These fees encourage miners or validators to process and secure transactions, maintaining the network’s integrity.

The exact cost depends on factors like transaction complexity and network congestion.

How Gas Fees Work

1. Transaction Processing Costs

Gas fees function as transaction processing costs, incentivizing miners or validators to confirm and include transactions in a new block. Several factors affect these costs:

| Factor | Impact on Gas Fees |

|---|---|

| Transaction Size | Larger transactions incur higher fees. |

| Complexity | More complex transactions require extra computation. |

| Network Demand | Heavy usage increases gas fees due to limited block space. |

| Currency Type | Different blockchains have unique fee structures. |

| Time Sensitivity | Urgent transactions often pay higher fees for faster speed. |

Staying aware of these factors helps users plan transactions and control expenses.

2. Network Congestion Impact

When network congestion rises—often due to a surge in users—gas fees can spike.

Miners prioritize transactions with higher fees, potentially delaying those with lower fees. Key influences during congestion include:

- Transaction Volume: More transactions compete for limited block space.

- Miner Preferences: Miners choose higher-fee transactions first.

- Block Size Limitations: Fixed block sizes can exacerbate delays.

- User Behavior: People may increase their fees during busy periods to expedite processing.

Gas Fees on Different Blockchains

Gas fees vary across blockchain ecosystems. These differences highlight the importance of choosing the right network for both cost and performance needs. Here’s the point to look up:

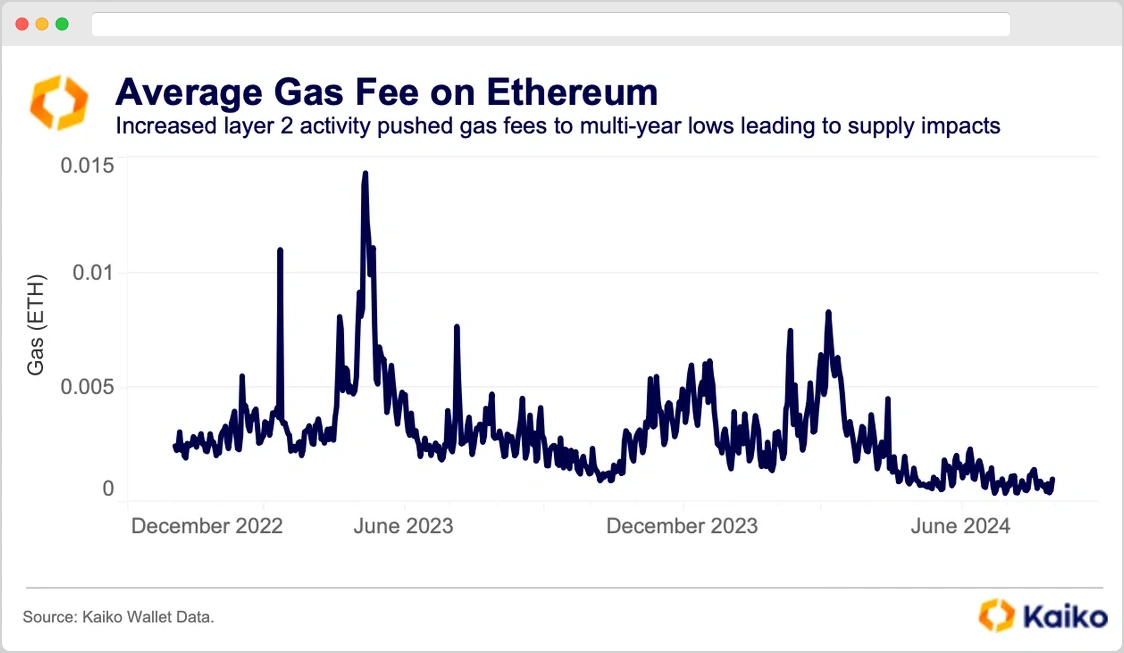

- Ethereum: Higher fees under heavy load due to its proof-of-work legacy (now partially mitigated by proof-of-stake and layer-2 solutions).

- Binance Smart Chain: Generally lower fees, popular among DeFi users for quicker and cheaper transactions.

- Polygon: Employs layer-2 scaling solutions, resulting in significantly reduced fees.

- Solana: Offers ultra-low fees and high throughput, ideal for high-frequency trading.

Importance of Gas Fees

1. Transaction Processing Efficiency

Gas fees are essential in maintaining speed and reliability in blockchain transactions:

- Prioritization: Higher fees encourage miners to process certain transactions faster.

- Network Stability: Sufficient fees prevent excessive congestion and maintain smooth operation.

- Cost Management: Reasonable gas fees keep transactions affordable for users.

- Incentivization: They provide financial motivation for miners or validators to secure the network.

2. Network Congestion Management

By varying with network load, gas fees help balance supply and demand:

- Bottleneck Prevention: During high traffic, increased fees deter spam and maintain throughput.

- User Adaptation: When fees are high, users can delay or optimize their transactions.

- Dynamic Pricing: Flexible fee models ensure the network remains responsive and functional.

Tips for Managing Gas Fees

- Monitor Network Conditions: Use real-time gas trackers to find less congested periods for transactions.

- Set Gas Limits: Define the maximum fee you’re willing to pay to avoid unexpected spikes.

- Batch Transactions: Whenever possible, consolidate multiple payments into one to minimize fees.

- Choose the Right Blockchain: Opt for platforms with lower or more stable fees for specific use cases.

Wrapping Up

Gas fees are central to blockchain performance, compensating miners for the energy and resources required to validate transactions.

Their cost can fluctuate significantly, as illustrated by Ethereum’s all-time high average fees exceeding $50 per transaction during peak demand in 2021.

By understanding how gas fees work across various blockchains and learning effective fee-management strategies, users can ensure faster, more affordable transactions and better navigate the ever-evolving cryptocurrency ecosystem.

Frequently Asked Questions (FAQs)

Can Gas Fees Be Refunded if a Transaction Fails?

Gas fees are typically non-refundable, even if a transaction fails. This is because the fee compensates network validators for their computational work. Users should carefully assess transactions to minimize potential losses associated with failed attempts.

What Happens if I Set a Gas Fee Too Low?

Setting a gas fee too low can lead to transaction delays or failures, as miners prioritize higher fees. Consequently, this may result in increased costs or missed opportunities within the dynamic cryptocurrency market, impacting overall investment strategies.

Are Gas Fees the Same for All Cryptocurrencies?

Gas fees vary substantially across different cryptocurrencies due to each network’s architecture and demand dynamics. Factors such as transaction complexity, network congestion, and protocol-specific mechanisms contribute to these variations, necessitating awareness for ideal financial planning.

How Do Gas Fees Impact Transaction Speed?

Gas fees substantially influence transaction speed within blockchain networks. Higher fees typically prioritize a transaction, resulting in faster confirmations. Conversely, lower fees may lead to delays, particularly during peak network activity, impacting overall efficiency and user experience.

Can I Avoid Gas Fees Entirely?

While completely avoiding gas fees is nearly impossible, akin to bypassing tolls on a highway, strategies like utilizing layer-2 solutions or selecting off-peak transaction times can substantially reduce costs while ensuring safer, more efficient transactions.