What is BTFD?

BTFD, an acronym of “Buy the f– dip“, widely used in financial markets, represents a specific investment approach that has gained significant popularity among traders and investors.

This concept revolves around market psychology, timing, and the ability to distinguish between temporary market corrections and prolonged downturns.

This article explores the meaning and origins of BTFD, examines strategies for identifying genuine dips, analyzes associated risks, and presents practical approaches for effectively implementing this investment philosophy.

Key Takeaways:

ShowWhat does BTFD Mean?

BTFD stands for “Buy the f– dip,” a term predominantly used in the cryptocurrency space by users who are extremely bullish on a particular project or the market as a whole.

This phrase appears frequently on social media platforms like X (formerly Twitter) and Discord, where enthusiasts use it to suggest that downward price movements present prime buying opportunities.

The core philosophy behind BTFD is not necessarily a sophisticated trading strategy but rather an optimistic mindset within the investment community, particularly among crypto enthusiasts who believe they are early adopters in a growing market.

BTFD represents more than just a tactical approach to buying assets at lower prices. It embodies a bullish attitude and serves as a rallying cry for investors who maintain confidence in an asset’s long-term potential despite short-term volatility.

The concept centers on the fundamental investment principle of “buy low, sell high,” with practitioners seeking to capitalize on temporary market corrections by purchasing undervalued assets at bargain prices.

Historical Origins

The BTFD mentality has a traceable history in modern financial markets. The first mention of BTFD on StockTwits dates back to December 2010, with the term gaining significant traction by May 2013.

The expression experienced initial popularity peaks followed by a period of steady decline until its resurgence in mid-2016. Since then, it has continued to maintain relevance in investment circles, particularly during bullish market runs.

The term’s usage tends to surge during periods of market volatility followed by recoveries, reinforcing its status as a communal expression that brings the trading community together through shared experiences in complex and high-stakes environments.

Historically, BTFD has been mentioned most frequently in relation to broad market indices like the S&P 500 ($SPY) or without reference to any specific asset, suggesting its application as a general market philosophy rather than a security-specific strategy.

Notable BTFD Historical Examples

The cryptocurrency market provides valuable case studies for understanding the outcomes of applying the BTFD strategy.

By examining past market movements, investors can better recognize the conditions that differentiate short-term corrections from deeper, prolonged downturns.

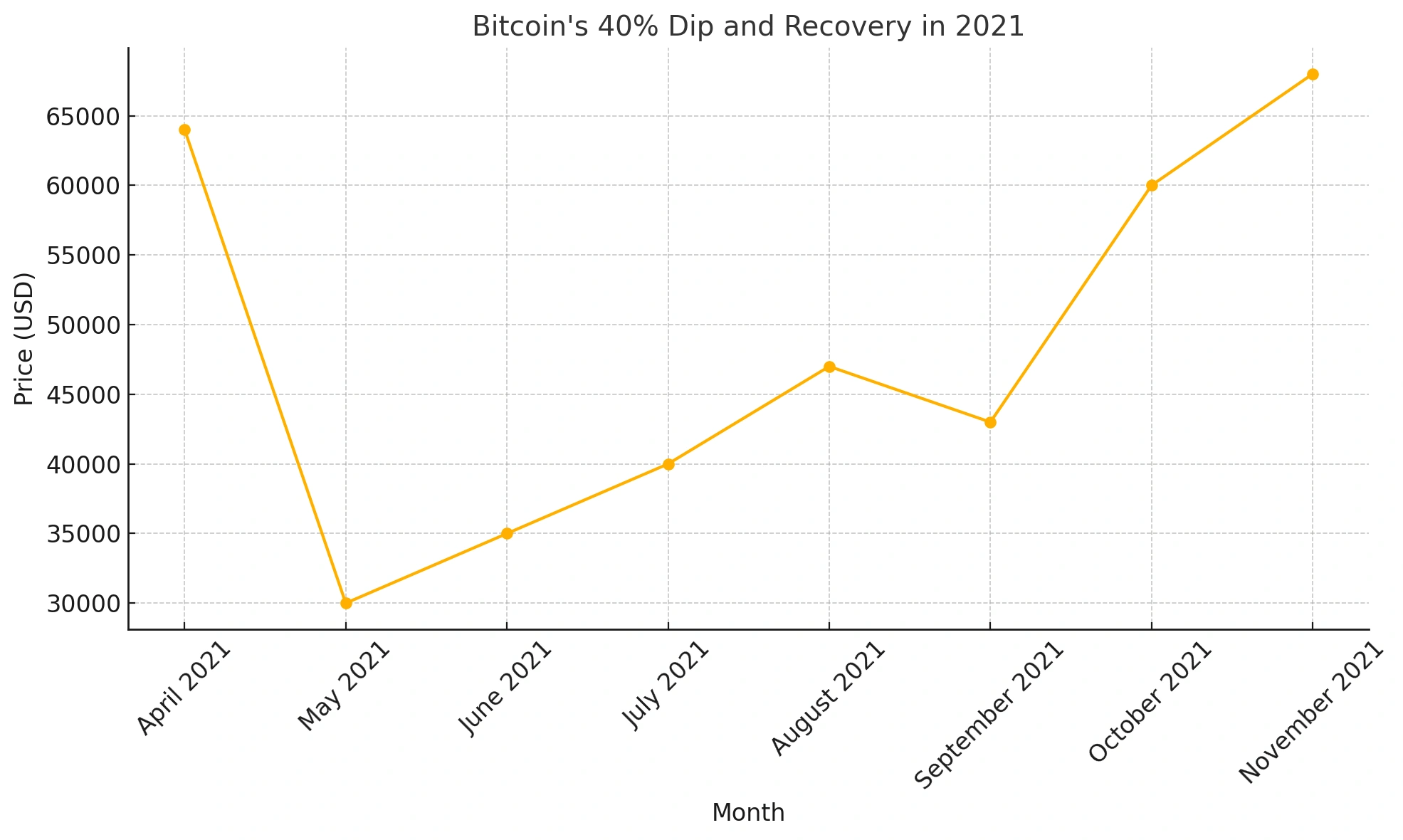

1. Bitcoin’s 40% Dip in 2021

In May 2021, Bitcoin fell sharply by about 40%, dropping from around $64,000 to $30,000.

Concerns over regulatory crackdowns in China and environmental criticisms contributed to the decline.

However, the broader fundamentals remained strong, with continued institutional interest and blockchain innovation.

Bitcoin recovered within months, reaching new highs by November 2021, illustrating a classic temporary dip that rewarded disciplined investors.

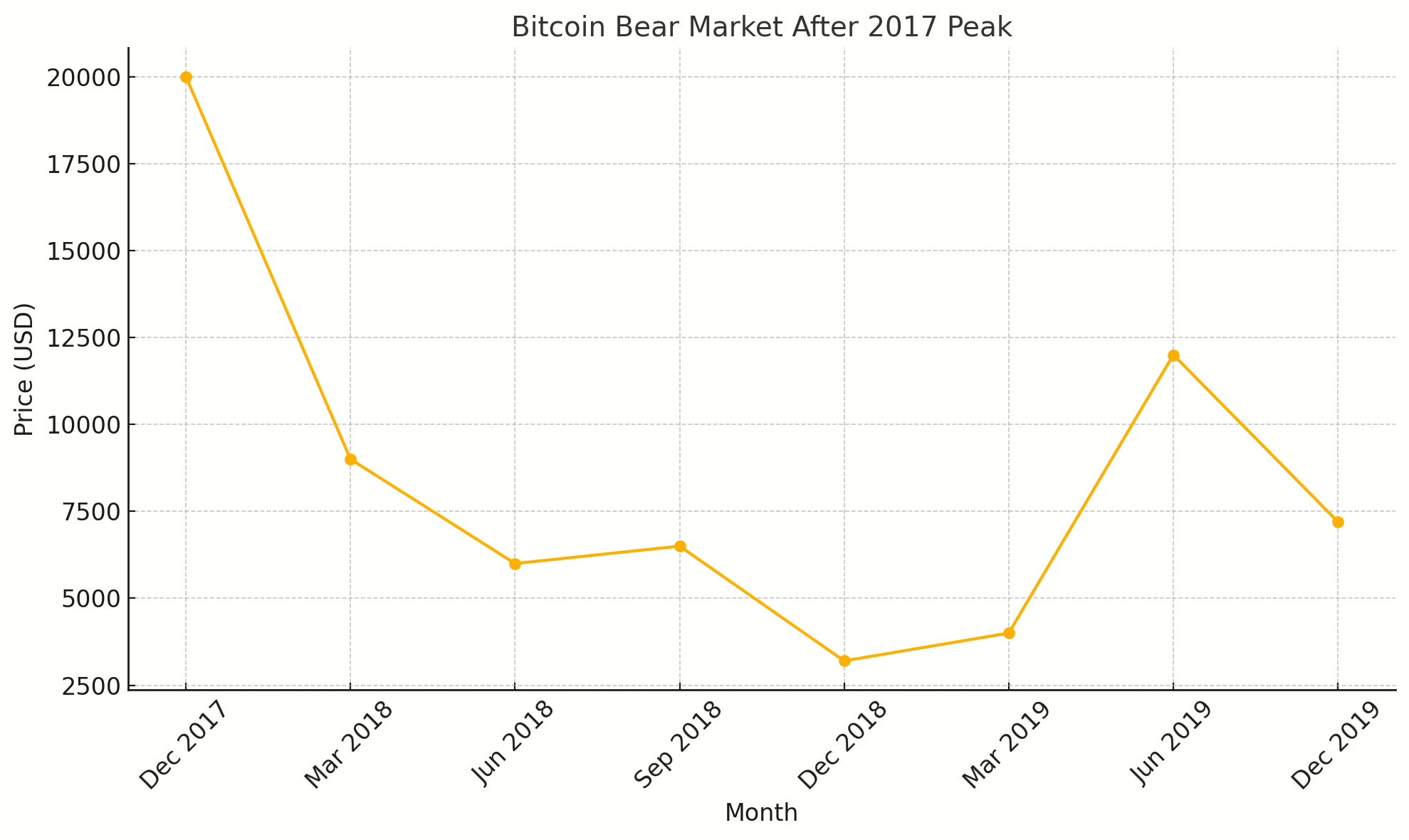

2. Cryptocurrency Bear Market After 2018

Following its 2017 peak near $20,000, Bitcoin entered a prolonged bear market in 2018, losing over 80% of its value.

Unlike 2021, this decline reflected deeper structural issues, including regulatory pressures and the collapse of speculative projects from the ICO boom.

Recovery was slow, taking over two years, and many altcoins never fully rebounded. Investors who misread this downturn as a temporary dip faced significant and lasting losses.

Identifying Market Dips vs Long-Term Declines

Identifying the difference between short-term market dips and the onset of long-term declines is critical for investors aiming to make informed decisions.

While both scenarios involve downward price movements, the underlying causes, magnitudes, and recovery timelines can vary significantly.

A clear understanding of these distinctions helps investors apply strategies like BTFD more effectively and manage associated risks with greater confidence.

Key Differentiating Factors

Several factors can help investors make this critical distinction:

1. Magnitude of Price Drops

A dip typically involves a 10-30% pullback during an overall bullish cycle, often triggered by profit-taking or short-term market panic.

These corrections usually resolve within weeks as the market absorbs the temporary setback.

In contrast, a bear market manifests as a much deeper decline, often characterized by a 50% or greater drop over an extended period.

These more severe downturns are typically fueled by fundamental macroeconomic factors, regulatory changes, or widespread market distrust rather than temporary sentiment shifts.

In cryptocurrency markets specifically, a potential indicator is the relative performance of different assets.

If Bitcoin (BTC) experiences a 15-25% decline while altcoins drop 40-50%, this pattern often signals a temporary dip rather than a structural market shift.

However, when Bitcoin plummets by 50-80%, it generally indicates the onset of a bear market.

2. Duration and Recovery Patterns

The timeframe of price declines provides another crucial differentiating characteristic. Dips are typically short-lived, lasting from a few days to several weeks, and feature relatively rapid rebounds.

For example, Bitcoin’s 40% drop in May 2021 fully recovered by November of the same year, representing a classic dip scenario.

Bear markets, by contrast, can extend over multiple years, as demonstrated by the prolonged crypto market downturn following the 2018 crash, which required over two years for recovery.

The recovery pattern across different asset classes can also provide insights – Ethereum (ETH) often shows early signs of recovery, while smaller altcoins may take considerably longer to rebound from genuine bear markets.

Analytical Approaches for Assessment

To effectively distinguish between dips and more serious declines, investors should employ a combination of technical and fundamental analysis:

1. Technical indicators

Using tools such as moving averages, support and resistance levels, and the Relative Strength Index (RSI) can help identify potential reversal points.

2. Fundamental evaluation

Assessing the underlying financial health, market position, and growth prospects of assets or companies provides context for price movements.

3. Broader economic assessment

Examining the overall economic landscape, regulatory environment, and market sentiment helps determine whether a price decline reflects temporary factors or more structural issues.

4. Historical pattern recognition

Comparing current market behavior with historical episodes of dips and bear markets can provide valuable perspective on the nature of the current decline.

Risks Associated with BTFD

While the BTFD approach can yield substantial returns when executed effectively, it carries several significant risks that investors must carefully consider:

The “Falling Knife” Phenomenon

One of the most common pitfalls in attempting to buy dips is the “falling knife situation,” where an investor purchases an asset during what appears to be a temporary decline, only to see prices continue to fall substantially.

This risk is particularly acute when investors act prematurely before a downtrend has fully played out.

Like catching a falling knife in real life, attempting to time the bottom of a market correction can result in significant financial harm if the asset’s price continues to decline sharply after purchase.

Misinterpreting Market Signals

Not every price decline represents a temporary dip with an eventual rebound.

Some price drops signal fundamental problems with the underlying asset or broader market conditions that could lead to prolonged downturns.

Investors applying the BTFD strategy risk misinterpreting these signals, potentially committing capital to assets that face long-term devaluation rather than temporary setbacks.

This misinterpretation risk is heightened during transitional market periods when economic conditions are shifting.

Timing Challenges

The BTFD approach inherently involves market timing – attempting to identify the optimal point to enter a position after a decline but before a recovery.

Even experienced investors find it extremely difficult to consistently identify the exact bottom of price movements.

Mistimed entries can significantly impact returns, either by purchasing too early (and facing further declines) or too late (missing substantial portions of the recovery).

Overexposure and Capital Depletion

Investors enthusiastically applying the BTFD mentality risk overextending their resources by repeatedly buying into declining assets, especially during prolonged downturns.

This behavior can lead to capital depletion and reduced ability to capitalize on genuine opportunities when they arise.

The emotional aspect of the BTFD philosophy can sometimes override rational capital allocation principles, particularly in volatile market environments.

Execution Strategies for BTFD

Effectively implementing a BTFD strategy requires disciplined execution and consideration of various factors:

Watchlist Development

Successful dip buyers maintain well-researched watchlists of assets with solid fundamentals that interest them from an investment perspective.

This preparatory work allows for quick decision-making when price declines occur, as the preliminary analysis is already complete.

The watchlist should include potential entry points based on technical and fundamental considerations for each asset of interest.

Capital Allocation Framework

Rather than deploying all available capital at once, effective BTFD practitioners allocate funds specifically for purchasing during market declines.

This approach might involve setting aside a certain percentage of the portfolio exclusively for opportunistic dip buying.

A staggered buying approach, where capital is deployed in tranches as an asset declines, can help mitigate timing risks and improve average entry prices.

Leverage Management

Successful BTFD execution requires careful management of leverage. While buying during dips can be tempting, investors should avoid excessive borrowing that could magnify losses if the market continues to decline.

The general principle is to invest only with capital that can be risked without creating unsustainable debt obligations, ensuring financial resilience regardless of short-term market movements.

Patience in Execution

Market recoveries after genuine dips can take time to materialize, sometimes requiring months for price normalization.

Effective BTFD strategies incorporate patience as a core principle, allowing time for investment theses to play out rather than expecting immediate results.

This patience extends to both entry timing (waiting for confirmation of potential bottoms) and holding periods after purchase (allowing sufficient time for recovery).

Analytical Tools for Implementation

Applying the BTFD strategy successfully relies on the use of appropriate analytical tools to guide decision-making.

By combining technical and fundamental analysis, investors can better assess market conditions, identify potential entry points, and manage risks more effectively.

Technical Analysis Approaches

Several technical analysis tools can enhance BTFD execution:

- Moving Averages: Monitoring an asset’s average price over specific time periods can help identify potential support levels and trend directions.

- Support and Resistance Levels: Identifying price levels where assets historically reverse their decline (support) or upward movement (resistance) provides reference points for potential entries.

- Relative Strength Index (RSI): This momentum oscillator helps calculate the velocity and magnitude of price movements, indicating whether an asset is potentially oversold (suggesting a buying opportunity) or overbought (suggesting caution).

Fundamental Analysis Components

Complementing technical approaches with fundamental analysis improves BTFD execution:

- Financial Health Assessment: Examining metrics such as revenue growth, profitability trends, and debt levels helps ensure that the asset’s underlying value remains intact despite price declines.

- Economic Context Evaluation: Considering broader economic indicators and trends that might affect the asset’s performance provides important context for determining whether a price decline represents a temporary setback or something more significant.

Risk Management for BTFD

Implementing effective risk management is essential for sustainable application of the BTFD approach:

- Defined Entry and Exit Parameters: Setting clear buy and sell points before initiating positions helps remove emotional decision-making during volatile market periods.

- Stop-Loss Implementation: Using stop-loss orders as automatic sell triggers if an asset’s price falls to predetermined levels helps limit potential losses.

- Portfolio Diversification: Spreading investments across different assets, sectors, and asset classes reduces concentration risk.

- Capital Preservation Focus: Allocating only a portion of investment capital to dip-buying activities helps maintain overall portfolio resilience.

- Continuous Market Monitoring: Regularly assessing market conditions and holdings’ performance ensures alignment with investment objectives and allows for timely adjustments.

Final Words

BTFD remains a popular investment philosophy centered around optimism during market declines.

While it can offer substantial rewards when applied carefully, it also carries significant risks if misused.

Success with this strategy depends on distinguishing between temporary dips and deeper downturns, applying disciplined execution, and maintaining sound risk management.

Understanding these factors is essential for any investor seeking to fully grasp what does BTFD means and how to apply it effectively.