Will Dogecoin Reach 1 Cent?

Dogecoin’s journey toward $0.01 has reignited debate among investors and analysts alike.

Some analysts predict a high of $0.31 by year’s end, noting that surpassing $0.1809 would be an important early milestone on the way to that target.

While it surpassed that level in 2021, reclaiming and sustaining one cent requires overcoming key technical barriers, macro headwinds, and an inflationary supply curve.

This article evaluates expert projections, chart patterns, adoption catalysts, to determine whether Dogecoin can realistically revisit the one-cent milestone.

Key Takeaways:

Hide- PrimeXBT: Predicts DOGE could hit $0.31 by December 2025. (Source: PrimeXBT)

- FXLeaders: Sees a $0.27 target if DOGE breaches $0.1809 resistance. (Source: FXLeaders)

- AltIndex: 50-day SMA at $0.17313 and RSI at 58.57 indicate neutral-to-bullish momentum. (Source: AltIndex)

- Yahoo Finance: Notes 146 billion DOGE in circulation, 10 000 coins minted per minute. (Source: Yahoo Finance)

- TokenMetrics: A 10% Bitcoin rally often triggers a 15–20% DOGE increase. (Source: TokenMetrics)

Price Prediction: Can DOGE Hit $1?

Evaluating Dogecoin’s path to $0.01 involves synthesizing diverse factors: expert forecasts, technical support and resistance, adoption drivers, inflationary pressures, and broader crypto trends.

Only by understanding how these elements interact can investors gauge the feasibility of a lasting rebound to one cent.

Expert Forecasts and Projections

Most bullish models position Dogecoin well above $0.01 by 2025 if favorable conditions persist.

Algorithmic forecasts suggest potential highs of $0.31 by December 2025, implying that a dip to one cent would merely be an interim foothold on the way up.

Technical trend-wave analyses forecast targets near $0.27, contingent on a decisive breach of the $0.1809 resistance.

These projections underscore that one cent is within reach, provided momentum aligns and broader market sentiment remains constructive.

Technical Analysis Overview

As of April 25, 2025, critical support lies at $0.1705 and $0.1650, while immediate resistance resides at $0.1780 and $0.1850.

A confirmed close above $0.1850 is required to establish a credible breakout path. The 50-day SMA at $0.17313 offers a near-term gauge for bullish bias, and a decisive move above the 200-day SMA at $0.24104 would signal sustained strength.

The RSI reading of 58.57 indicates neutral-to-bullish momentum, but only a push above 50 coupled with rising volume can validate a trend toward higher price points, including $0.01.

Catalysts for a $0.01 Surge

Several triggers could ignite a rally to one cent: a meaningful endorsement or product rollout by a major retailer adding Dogecoin as a payment option could boost demand by 10–15%.

Ethereum-style token burns or developer-driven scarcity initiatives might create temporary supply shocks.

Also a strategic marketing campaigns timed with macro tailwinds, such as Bitcoin halving or easing monetary policy, could amplify retail interest.

Yet, each catalyst must coincide precisely with technical breakouts to overcome resistance and lasting inflation.

Supply and Inflation Dynamics

Dogecoin’s inflationary model mints 10,000 new coins every minute, swelling the circulating supply beyond 146 billion.

Without a mechanism to curb or burn tokens, the supply glut continually offsets buying pressure.

A hypothetical 10% burn of existing tokens could temporarily elevate prices by 5–10%, but this one-off action fails to address ongoing inflation.

Unless the network adopts permanent supply controls or deflationary upgrades, each upward move faces diminishing returns as new tokens dilute equity.

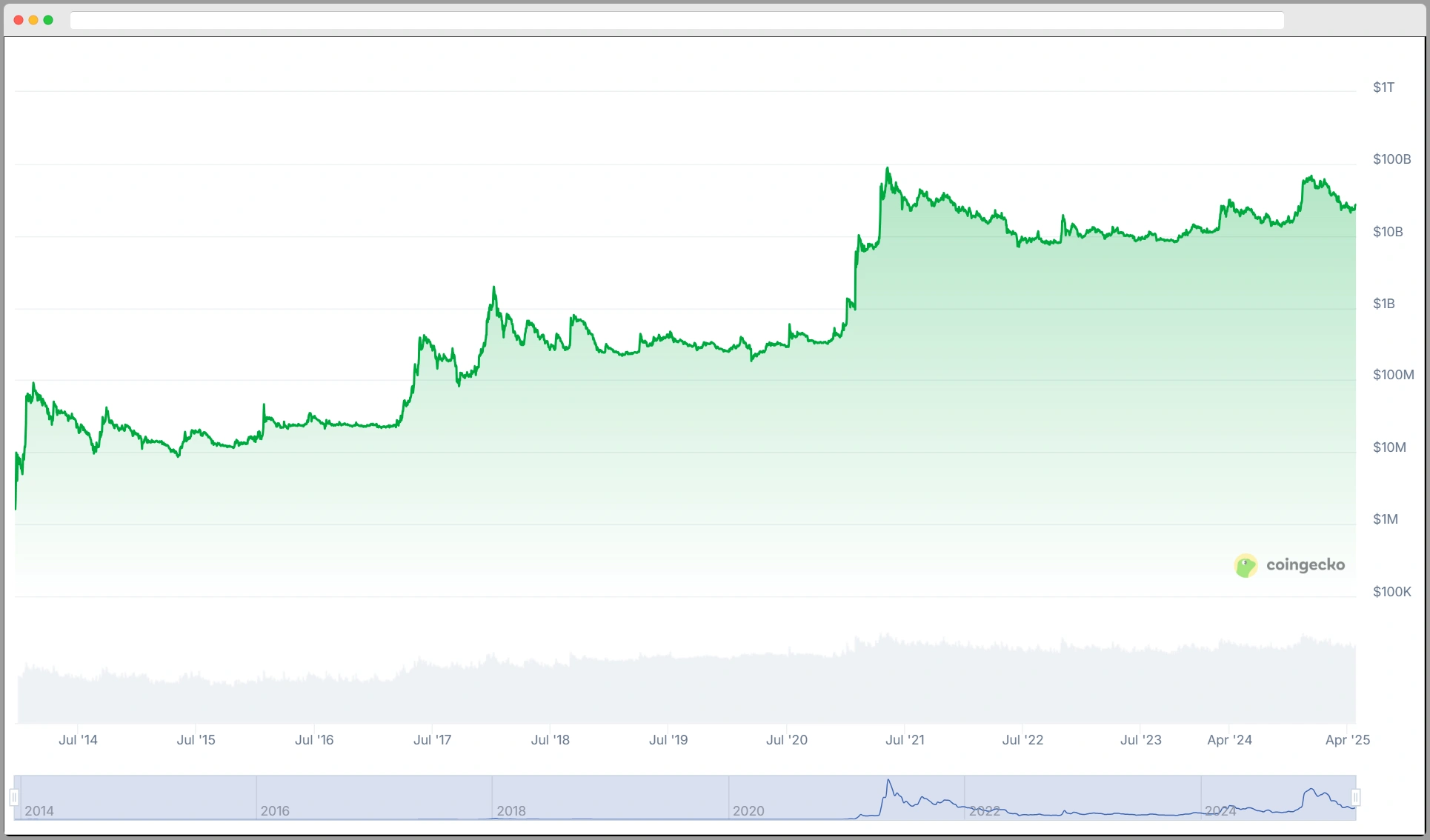

Bitcoin Correlation and Macro Trends

Dogecoin remains tethered to Bitcoin’s fortunes. Historically, a 10% Bitcoin rally translates to a 15–20% Dogecoin uptick, though this correlation has weakened amid growing self-direction.

A sustained Bitcoin bull run, driven by halving cycles or regulatory clarity, could provide tailwinds strong enough to carry Dogecoin back above one cent.

Conversely, broader market downturns or crypto-specific crackdowns can extinguish momentum, leaving Dogecoin unable to reclaim even modest price thresholds.

Tips for Approaching Dogecoin’s $0.01 Target

Navigating Dogecoin’s volatility requires disciplined strategy and rigorous risk controls. By combining technical confluence, catalyst monitoring, and strict position limits, traders can improve their odds of capturing rebounds while limiting downside exposure.

- Wait for Technical Confirmation: Enter only after a daily close above $0.1850 with volume exceeding the 20-day average.

- Set Layered Stops: Use cascading stop-loss orders at 10% and 20% below entry to manage sudden reversals.

- Monitor Adoption News: Track announcements of major payment integrations or burn proposals to anticipate demand surges.

- Watch Inflation Metrics: Stay alert for token-burn initiatives or supply-cap discussions to gauge scarcity effects.

- Align with Bitcoin Moves: Time entries around Bitcoin rallies for amplified upside potential.

- Limit Allocation: Cap Dogecoin exposure to no more than 2% of portfolio value given its high-risk profile.

Concluding Statements

Dogecoin attaining $0.01 is plausible under a convergence of favorable factors: a decisive technical breakout above $0.1850, a reduction or burn of supply, institutional adoption catalysts, and a supportive macro-crypto led by Bitcoin strength.

However, persistent inflation and wavering market sentiment pose significant headwinds.

Investors should approach Dogecoin as a speculative play, employing strict risk management and remaining vigilant for both bullish confirmations and bearish reversals.