Will Ethereum Overtake Bitcoin?

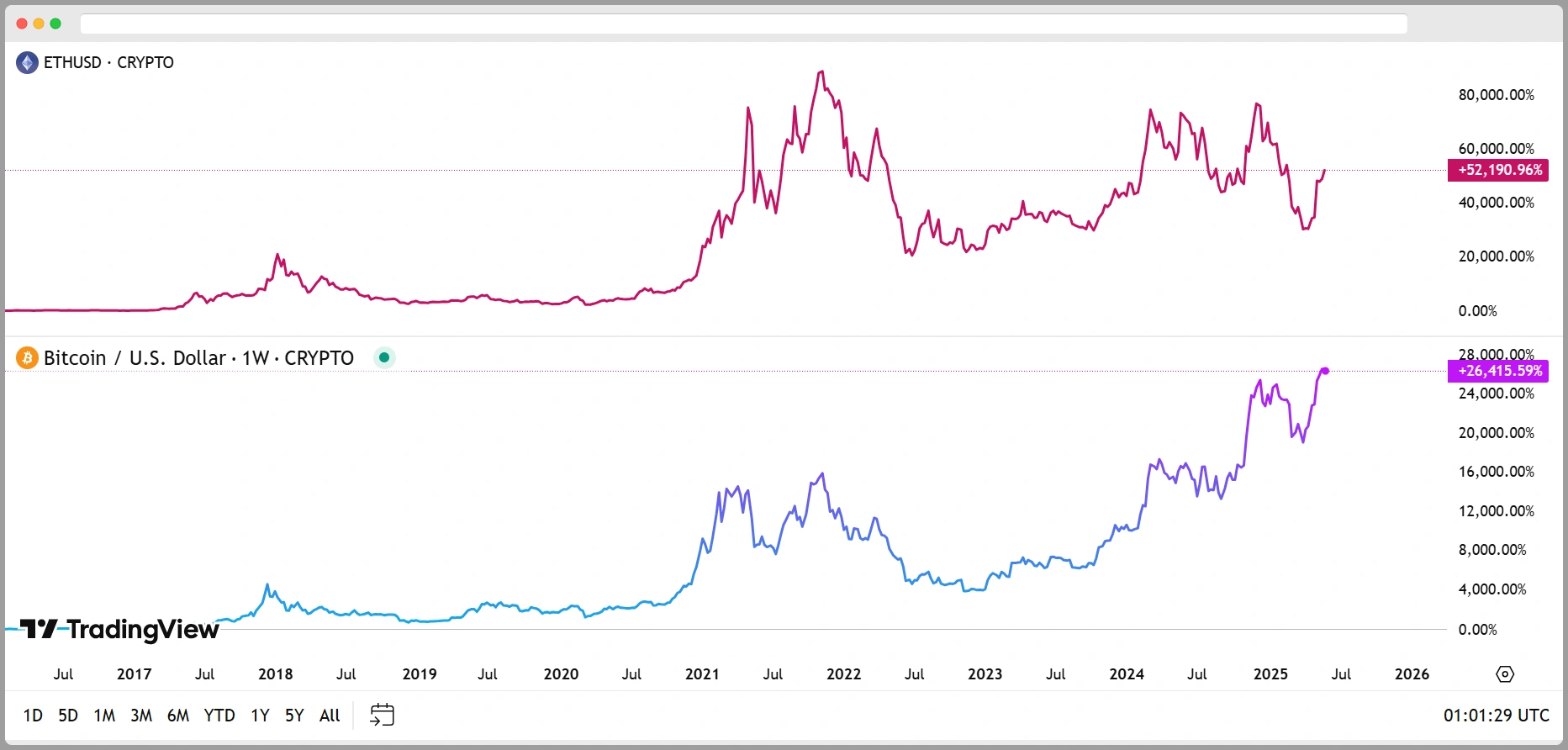

It’s the question crypto fans love to debate: Will Ethereum overtake Bitcoin? The short answer? Bitcoin’s still the king of the hill, but Ethereum’s got a real shot at closing the gap over time.

BTC leads with its massive market cap and “digital gold” status. While ETH getting more recognition, thanks to its real-world utility, deflationary mechanics, and a vibrant community that’s pushing the boundaries of what crypto can do.

Key Takeaways:

ShowMarket Scoreboard: BTC Lead vs ETH Hustle

Bitcoin (BTC) got the crown for a reason. It was the first crypto, it’s got the biggest market cap (roughly three times Ethereum’s), and it’s the go-to for people who see crypto as a safe store of value.

Bitcoin is like the gold standard of digital money—reliable, liquid, and widely trusted. That’s why people seek free Bitcoin and wonder how much of BTC is enough.

Meanwhile, Ethereum is the busy bee of the crypto world. It’s not just a currency; it’s a platform powering thousands of decentralized apps, from NFT marketplaces to lending protocols.

The fact that Ethereum (ETH) processes way more transactions daily than Bitcoin, and all that activity—think DeFi projects, smart contracts, and token creation—drives demand for ETH.

What’s the catch? For Ethereum to catch Bitcoin, it needs to grow faster and sustain that momentum long enough to chip away at Bitcoin’s lead. We’ve seen Ethereum outpace Bitcoin in short bursts, but it’s a marathon, not a sprint.

Ethereum’s Superpower: Real-World Utility

Bitcoin’s great for holding value, but Ethereum’s built for action. It’s like a digital Swiss Army knife—programmable, flexible, and powering billions in daily transactions. Here’s why that matters:

- Smart Contracts: Ethereum lets developers build apps that run on its blockchain, from decentralized exchanges to gaming platforms. That’s real-world use driving real-world demand.

- Fee Burning: Every time someone uses Ethereum, a tiny bit of ETH gets “burned” (destroyed). Heavy usage = fewer coins over time, which can push prices up.

- Staking Rewards: People who lock up their ETH to help secure the network earn rewards. This reduces the amount of ETH floating around, tightening supply.

Why this matter: The more people use Ethereum’s ecosystem, the more ETH they need. It’s like fuel for a rocket ship—and that demand could send prices soaring.

Scarcity Showdown: Simple vs Sophisticated

Bitcoin’s scarcity is its superpower. With a hard cap of 21 million coins, it’s a straightforward pitch: there’s only so much to go around, so grab it while it lasts. That simplicity draws in cautious investors who love predictability.

Ethereum’s approach is a bit more complex. There’s no fixed cap on ETH, but its fee-burning and staking mechanics can make it deflationary when usage spikes.

Fewer coins in circulation? That’s a recipe for price growth. The catch is that Ethereum’s story isn’t as easy to grasp as Bitcoin’s “only 21 million” mantra, which can make some investors hesitant.

The bottom line: Ethereum’s economics are powerful but need more time and trust to win over the masses compared to Bitcoin’s crystal-clear scarcity.

Who’s Got the Hype? Community and Big Money

Bitcoin’s got the institutional edge. Think ETFs, corporate treasuries, and big funds piling in. It’s the crypto equivalent of a blue-chip stock—safe, established, and deeply rooted in the financial world.

Ethereum, on the other hand, has a different kind of energy. Its developer community is massive, building everything from art platforms to financial tools.

That grassroots vibe is a magnet for innovation, but Ethereum’s waiting on clearer regulations—like for ETH-based ETFs or staking rules—to unlock a flood of institutional cash.

What to watch: Once the rules around Ethereum get clearer, big investors might start pouring in, drawn by its unique use cases and growth potential. That’s why experts projecting ETH might be step into a $500K – $100K range by 2040.

The Confidence Trifecta

Its common that HODLer might feel worry sometimes when thinking of the future of ETH for the next 5 years, or even another 10 years.

Overshadowed by BTC succeed, leads to people for asking, “Will Ethereum overtake Bitcoin?”. In this phase, they’re really looking for three things to feel good about their bet:

| Vibe Check | Money Moves | Tech Edge |

|---|---|---|

| “Is everyone jumping on the Ethereum train?” | “Is real money flowing into Ethereum?” | “Does Ethereum’s tech make it a winner?” |

| Social buzz and community trust matter. | Look for rising transaction volumes and ETF/fund inflows. | Fee burns and staking rewards tighten supply. |

When these three—mindset, market signals, and protocol mechanics—line up, Ethereum’s path to catching Bitcoin feels less like a pipe dream and more like a possibility.

It’s about people believing in it, money backing it, and the tech delivering.

So, Will Ethereum Overtake Bitcoin?

Recently, experts and analysts have been assessing ETH’s growth potential by 2025—and even 2030—projecting valuations around $10,000 per ETH in a moderate scenario, and up to $100,000 in an ideal bullish case.

So, the questions still remain, it will take BTC place? Well, not tomorrow, and probably not next year. Bitcoin’s lead is huge, and its “digital gold” reputation isn’t fading anytime soon.

But Ethereum’s got something special: a thriving ecosystem, a deflationary edge, and a community that’s building the future of finance, art, and more.

If it keeps growing its user base, burning fees, locking up supply, and winning over big investors as regulations clear, Ethereum could seriously narrow the gap—or even flip the script—in the long run.

If you’re wondering Will Ethereum overtake Bitcoin?, keep an eye on those three pillars: buzz, adoption, and mechanics. They’ll tell you more than any price chart ever could.