Will PEPE Reach 1 Cent?

As a popular meme coin, PEPE Coin potential to reach 1 cent has been sparked debates by analysts and fans alike.

With an enormous circulating supply and challenging market dynamics, achieving a 1 cent valuation appears extremely unlikely.

This article breaks down each factors influencing PEPE’s price, from technical indicators, and scenarios where transformative shifts might drive PEPE toward the elusive 1 cent mark these days.

Key Takeaways:

Hide- Binance analysis indicates that reaching 1 cent would require a market cap over $4 trillion, a scenario deemed highly improbable. (Source: Binance)

- CoinCodex projects a modest increase, forecasting a price target of $0.00002322 by April 27, 2025, well below the 1 cent mark. (Source: CoinCodex)

- Changelly expects PEPE's long-term value to remain within the $0.0000540 to $0.0000630 range by 2030 under current conditions. (Source: Changelly)

- Telegaon estimates a maximum price of 0.0000656 by 2026, highlighting the significant gap to 1 cent. (Source: Telegaon)

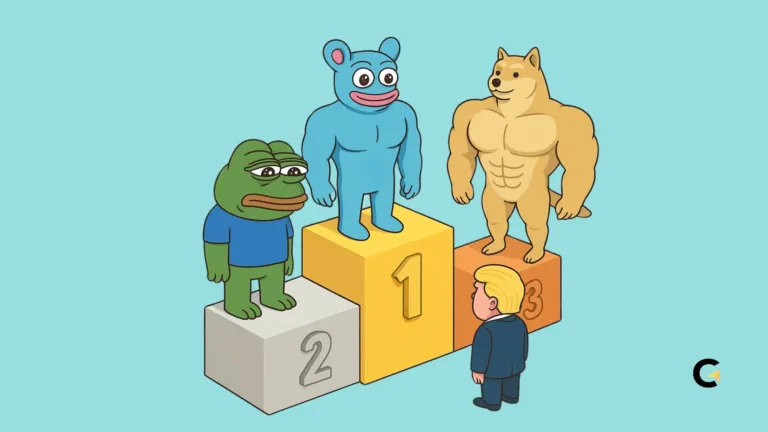

PEPE Coin Prediction: Is it Possible to Reach 1 Cent?

This section provides a detailed examination of the factors that could influence whether PEPE reaches 1 cent.

We explore market capitalization requirements, token burn strategies, bull market influences, and technical analysis perspectives.

Read more: Can PEPE coin reach $1?

Each aspect is analyzed to understand the structural challenges and speculative scenarios that drive price movements in meme coins.

Market Capitalization Requirements

For PEPE Coin to achieve a 1 cent price, its market capitalization would need to exceed $4 trillion.

Given its enormous circulating supply, such a valuation would dwarf even Bitcoin’s current market cap.

This immense target reflects the sheer scale of growth required, and it highlights the improbability of reaching 1 cent without massive shifts in global market dynamics.

Token Burn Strategies

A drastic reduction in circulating supply via token burns is often cited as a potential mechanism to boost price. However, even aggressive burns might only modestly lower supply levels.

Without near-total burning of tokens, a scenario that is highly unlikely, the impact on price is limited, rendering it challenging for PEPE to reach the 1 cent threshold under normal market conditions.

Bull Market Dynamics

A sustained and overwhelming bull market in leading cryptocurrencies like Bitcoin and Ethereum could generate renewed speculative interest in meme coins like PEPE.

In such periods, heightened investor sentiment and liquidity influx may drive sharp price surges.

Nevertheless, the leap from the current price levels to 1 cent remains astronomically high, even in an exceptionally strong bull market.

Technical Analysis Perspective

Short-term technical indicators may occasionally signal bullish trends, such as breakouts or trend reversals.

While technical charts can indicate potential for rapid rallies, the fundamental barriers, stemming from the massive token supply and market cap requirements, mean that these signals are unlikely to translate into long-term price transformations sufficient to reach 1 cent.

Things to Maximize when Investing in PEPE

Below are essential tips and best practices for investors assessing the potential of PEPE Coin. Use these actionable insights to form a more realistic investment thesis.

- Monitor Market Cap Projections: Understand that achieving a 1 cent price requires a market cap exceeding $4 trillion. Such astronomical figures imply that investors should remain cautious and realistic.

- Evaluate Token Burn Impact: Consider the effectiveness of token burn strategies. Even aggressive burns may not sufficiently reduce the circulating supply to drive significant price increases.

- Assess Bull Market Trends: Keep an eye on broader market movements in cryptocurrencies, particularly Bitcoin and Ethereum, since their bullish phases can indirectly influence meme coins.

- Analyze Technical Signals Carefully: Use technical indicators to identify short-term rally opportunities, but balance these signals with an understanding of long-term supply constraints.

- Set Realistic Expectations: Given the current market structure, base your projections on conservative estimates rather than speculative targets.

Conclusion

In final words, the analysis shows that while PEPE Coin might experience short-term rallies driven by market sentiment and technical trends.

Achieving a 1 cent valuation remains highly unlikely due to its massive circulating supply and the consequent market cap requirement exceeding $4 trillion.

Price predictions currently suggest modest percentage gains rather than a transformative leap to 1 cent.