Will Ethereum Reach $100,000?

Ethereum’s journey toward higher valuations now draws added attention as fresh expert analyses forecast a potential price range that spans around $100,000 to an ambitious high of roughly $180,000 per ETH.

This updated perspective reinforces Ethereum’s standing as a major player, driven by its evolving technological upgrades and growing adoption across decentralized finance.

While the transformative effects of network upgrades and smart contract innovations remain central to its future.

In this article, we will learn how critical broader financial shifts and institutional momentum will be in setting the price up to $100,000 per ETH.

Key Takeaways:

Hide- Cathie Wood’s ARK Invest: ARK Invest projects Ethereum’s market cap could hit $20 trillion by 2030, translating to roughly $170k–$180k per ETH if DeFi drives global finance. (Source: Markets Insider)

- Frank Holmes (U.S. Global Investors): Holmes predicts Ethereum could reach $100k within the next decade, based on supply constraints and rising network adoption. (Source: The Daily Hodl)

- Arthur Hayes (BitMEX): Hayes forecasts ETH could hit $100k, driven by macroeconomic trends, fiat debasement, and renewed bullish crypto sentiment. (Source: The Daily Hodl)

- Brian Schuster (Ark Capital LLC): Schuster argues that if ETH evolves into a digital gold with a $10 trillion market cap, its price could reach around $100k per coin. (Source: ZyCrypto)

- Nikhil Shamapant (Independent Analyst): Shamapant’s “ultra-bull case” envisions ETH reaching up to $150k, citing fee burns and proof-of-stake-induced supply shocks. (Source: Reddit/DECRYPT)

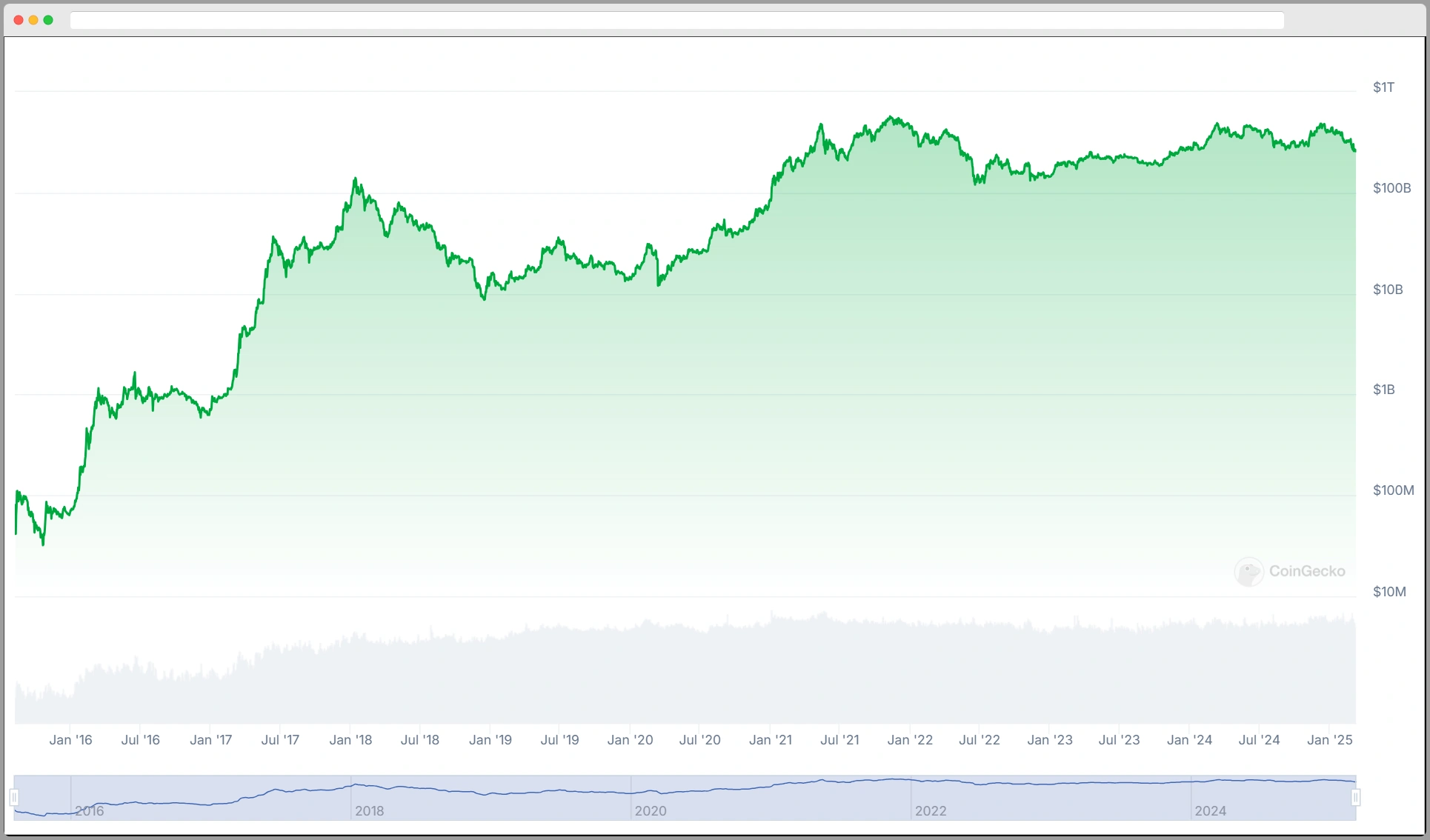

Ethereum’s Current Position in the Market

As Ethereum continues to navigate the volatile landscape of cryptocurrency, its current market position reflects a complex interplay of technological advancements and investor sentiment.

Recent data indicates that Ethereum has maintained a significant market capitalization, positioning it as the second-largest cryptocurrency by market value.

The implementation of Ethereum 2.0 has garnered attention, showcasing its shift to a proof-of-stake consensus mechanism, which promises enhanced scalability and energy efficiency.

Additionally, the rise of decentralized finance (DeFi) applications built on the Ethereum blockchain has solidified its relevance in the financial ecosystem.

However, fluctuations in investor confidence, driven by macroeconomic factors and regulatory scrutiny, contribute to its price volatility.

Understanding these dynamics is essential for any analysis of Ethereum’s future trajectory.

Key Factors Driving Ethereum’s Growth

Smart Contracts Adoption

Ethereum’s ability to execute smart contracts has set it apart as a leader in decentralized applications (dApps).

These contracts automate processes, reduce costs, and enhance security, which drives efficiency and fosters trust.

The result is a wide-ranging applicability across industries, from finance to supply chain management.

| Key Factor | Impact on Adoption |

|---|---|

| Automation of Processes | Increased efficiency |

| Cost Reduction | Lower operational costs |

| Security Enhancements | Enhanced trust |

| Industry Versatility | Wide-ranging applications |

Decentralized Finance Expansion

Decentralized Finance (DeFi) has democratized access to financial services on Ethereum by enabling lending, borrowing, and trading without intermediaries.

The surge in total value locked (TVL) in DeFi protocols highlights Ethereum’s pivotal role in this financial revolution.

Innovations such as yield farming and liquidity mining are attracting a diverse range of participants, further driving demand.

Layer 2 Solutions

To address scalability challenges, Layer 2 solutions like Optimistic Rollups and zk-Rollups enable faster and cheaper transactions.

By reducing network congestion, these technologies improve the user experience and support high-throughput decentralized applications, thereby strengthening Ethereum’s market position.

Role of Smart Contracts and dApps

Smart contracts and dApps underpin Ethereum’s functionality. They enable trustless, transparent, and secure interactions by automating processes and reducing reliance on intermediaries. Key benefits include:

- Automation: Execution of agreements when conditions are met.

- Transparency: Public ledger records that promote accountability.

- Security: Robust cryptographic safeguards.

- Interoperability: Seamless interactions with other blockchain protocols.

- Cost Reduction: Lower operational costs by eliminating third-party fees.

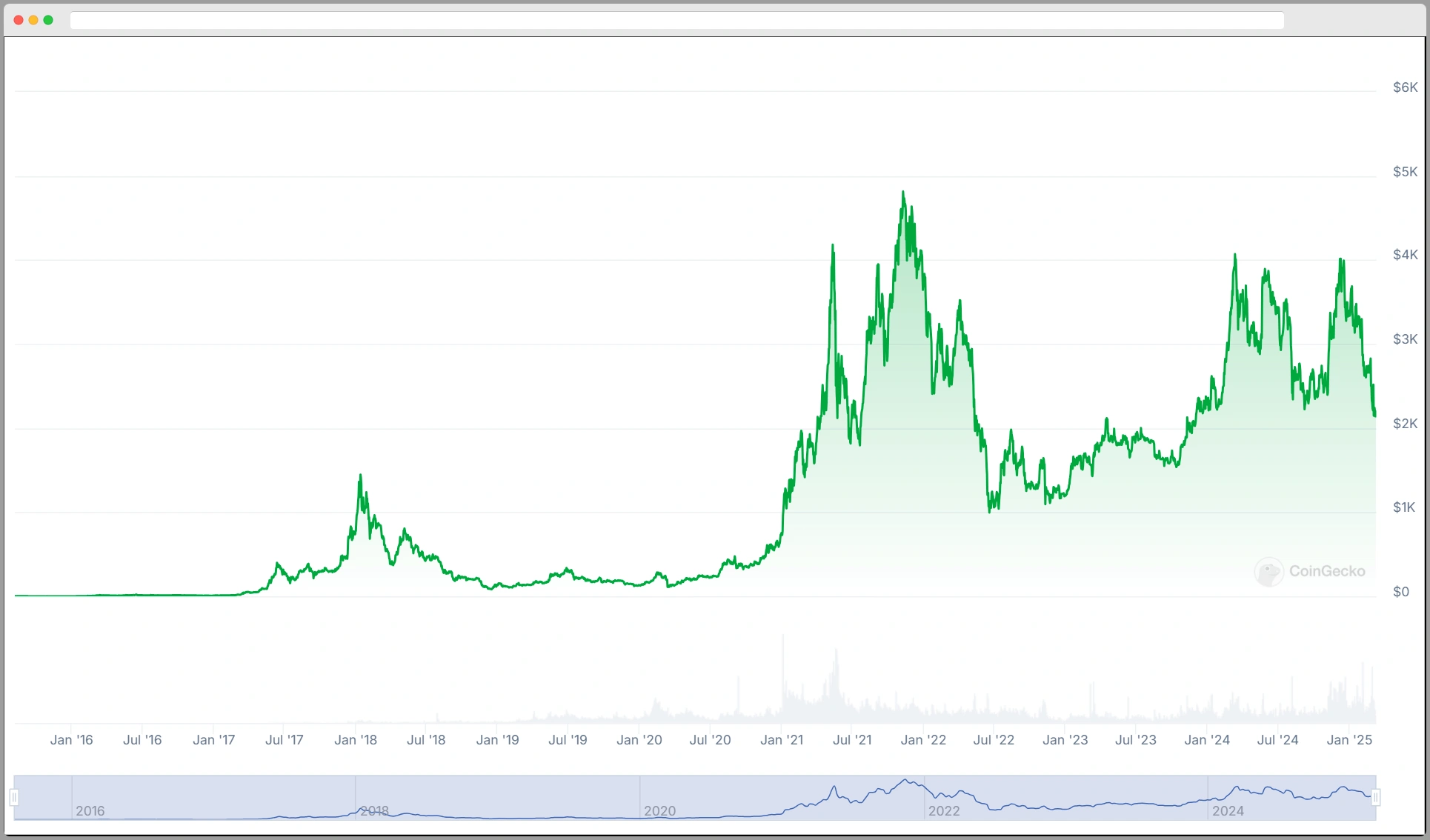

Market Volatility and Its Impact on ETH Price

Ethereum’s price trajectory is strongly influenced by market volatility. Understanding these trends is vital for forecasting future price movements.

Historical Price Fluctuations & Sentiment Analysis

Past price movements illustrate the impact of regulatory changes, technological forks, and global economic conditions on investor behavior.

Data-driven sentiment analysis, using social media metrics and trading volumes, often correlates positive sentiment with price increases, while negative sentiment can lead to declines.

Regulatory Influence on Trends

The regulatory environment plays a critical role in shaping market trends. Clear regulations can bolster investor confidence and promote institutional adoption, whereas uncertain or restrictive policies may heighten volatility.

The effects of securities laws, tax policies, and data protection regulations all contribute to Ethereum’s evolving market dynamics.

Regulatory Developments Affecting Ethereum

Global regulatory changes are increasingly important. Clarity in regulation can foster institutional investment, while overly strict measures might inhibit growth. Key areas include:

| Regulation Type | Impact on Ethereum | Current Status |

|---|---|---|

| Securities Regulations | Increased compliance costs | Under review |

| Tax Regulations | Greater transparency | Proposed changes |

| Anti-Money Laundering | Enhanced credibility | Widely enforced |

| Data Protection Laws | Necessity for robust privacy | Evolving globally |

| Stablecoin Regulations | Market stability and trust | Under legislative review |

Competition from Other Blockchain Platforms

Despite its leading role in smart contracts and dApps, Ethereum faces growing competition from platforms such as Cardano, Solana, Polkadot, Avalanche, and Binance.

These competitors offer enhanced scalability, lower transaction costs, or unique features that may challenge Ethereum’s market dominance, urging continuous innovation.

Potential Scenarios for Ethereum’s Future Price

Several potential scenarios now emerge from the latest predictions:

- Optimistic Outlook: In a scenario where Ethereum’s technological advancements, such as its transition to proof-of-stake and the expansion of DeFi applications, catalyze widespread institutional and global adoption, ETH could surge to around $180,000.

- This vision hinges on Ethereum becoming a fundamental layer for global financial transactions and capturing a dominant market share.

- Competitive Pressure Scenario: Should competing blockchains attract significant users or if technological challenges persist, investor sentiment may temper Ethereum’s growth.

- In this case, ETH might stabilize closer to the $100,000 mark, reflecting a market that remains cautious despite the platform’s inherent strengths.

- Macroeconomic and Regulatory Shifts: Favorable macroeconomic trends and clearer regulatory frameworks could create a sweet spot for Ethereum.

- Under this condition, a balanced interplay between innovation and market stability might drive ETH to intermediate levels, potentially around $150,000, as network effects and demand dynamics accelerate its value.

Wrapping Up

Finally, the updated expert forecasts paint a picture where Ethereum’s future price lies between a lower threshold of approximately $100,000 and could climb as high as about $180,000.

This range reflects varying scenarios, from a cautious environment where competitive and regulatory challenges keep growth modest, to a bullish outlook where Ethereum’s evolving ecosystem and its role as a backbone for digital finance drive its valuation to new heights.

These projections, underscore the potential of Ethereum while acknowledging its value or price up to $100,000 will be shaped by both the pace of technological adoption and the prevailing financial environment.